Financial services companies rely on data for practically every aspect of their business. But inaccurate financial and operational data can paint a misleading picture of their performance and lead to disastrous business strategies, while incomplete data about customers can result in poor lending decisions and losses. Adding to those challenges, incorrect data can undermine efforts to comply with regulations designed to protect customer privacy, reduce risk, and prevent fraud and money laundering.

This article dives into eight of the biggest data challenges in financial services and shows how to solve them.

What Are Data Challenges in Finance?

Financial services firms face a variety of data-related challenges that can hinder their ability to operate efficiently, create personalized products, manage risk, and ensure regulatory compliance. For instance, when critical data is locked away in siloed departmental systems—as is often the case—it can be difficult to gain insights into overall business performance. Gaps in data and incompatibilities among disparate systems impede the ability to build a complete view of customer preferences and tailor financial products to their needs. Missing, inaccurate, or outdated information about customers also makes it tough to accurately assess financial risks, detect fraud, and comply with regulatory requirements.

Key Takeaways

- Financial services firms need reliable, integrated data systems to effectively analyze business performance, manage risk, and maintain regulatory compliance.

- Missing, outdated, or siloed data can compromise strategic decision-making.

- The need to analyze and process big data can also outstrip the capabilities of existing systems.

- Solutions include establishing better data governance and implementing application suites and data warehouses that integrate data into a single database.

Why Is Data Accuracy Important in Finance?

Without accurate data, financial services companies—including banks, insurers, payment providers, asset traders, and alternative lenders—cannot measure, analyze, or predict business performance. Accordingly, CFOs and finance leaders rate metrics, analytics, and reporting as their top focus area for 2025, reflecting an emphasis on delivering insight to improve business performance, according to Gartner. Inaccurate data also makes it challenging to introduce innovative applications and products based on artificial intelligence (AI), which are only as valuable as the data used to train them. Indeed, 35% of CFOs surveyed by Gartner cited poor data quality as a key inhibitor for AI adoption in finance.

The Top 8 Data Challenges in Finance and Their Solutions

From missing or unreliable data to an overwhelming volume of data that’s hard to manage, financial services companies—and the CFOs and analysts charged with data oversight—may struggle to understand what’s going on within the business and to assess financial risk. Data management, analyses, reporting, and regulatory compliance also become unwieldy. However, these challenges can be confronted and overcome, often through advanced technology.

1. My Organization Has Data Gaps

Data may be missing for a variety of reasons, such as because employees haven’t filled in every data field for a specific customer or transaction, or they have mistyped data, which leads to miscategorization. These problems are particularly common when organizations lack standards for data collection and data quality. Other gaps become apparent when the organization tries to analyze data from multiple systems, each designed for a specific purpose. Newer privacy, security, and know-your-customer regulations may also require data that wasn’t needed when older legacy systems were implemented.

Data gaps can cause serious problems, including incomplete or inaccurate financial reporting. If the company can’t produce information needed for compliance reports or audits quickly enough, it can incur fines and other penalties, as well as reputational damage. Missing or insufficient data also makes it more challenging and labor-intensive to analyze data and make better-informed business decisions.

-

Solution:

Organizational changes, training, and technology all play important roles in finding and plugging data gaps. A comprehensive audit of the organization’s data can help identify where and why gaps exist. Establishing consistent policies for data collection, storage, and formatting is also important, as is staff training that explains the value of accurate and complete data entry. Many organizations benefit from migrating their collection of departmental systems to an integrated enterprise resource planning (ERP) system that delivers a single source of data.

2. My Data Sources Are Unreliable or Out of Date

In an ideal world, every piece of data—whether derived from a financial service firm’s internal operational systems or from its external sources, such as newsfeeds, payment systems, consumer credit bureaus, and social media—would be consistent and 100% accurate. But, in reality, some systems may update their information less frequently than others. Others rely on manual data entry, which can introduce errors. Some financial information may still be stored in spreadsheets that are manually created and rarely updated, while departmental systems may hold conflicting information because of the way their data was originally entered. The bottom line: It’s hard to make sound decisions based on poor-quality, untrustworthy data—and any actions that result from those inferior decisions can have adverse financial impacts.

-

Solution:

Given the number and increasing diversity of data sources, it may be difficult to separate trustworthy, current information from the noise. Instituting clear data governance policies that establish responsibility for keeping data up to date and that ensure consistent, timely data across internal systems is one way to gain control. Data validation tools can help prevent inaccurate data entry. So can replacing manual processes with automated data collection and updates that replace old information. Over the long term, moving to an integrated business application suite that stores business data in a unified database can eliminate data discrepancies caused by a mishmash of systems.

3. I Need to Stay Aware of Privacy and Compliance Rules

The financial services industry operates within a complicated web of evolving regulations in areas such as cyber risk, data governance, and financial risk management, according to KPMG. Staying current with regulations can involve a considerable amount of work, particularly when companies have to comply with local and national industry regulations. In addition to adequately securing sensitive data and protecting customers’ privacy, financial institutions typically need to prepare regular compliance reports and report suspicious transactions. In the event of a regulatory audit, they must be able to quickly gather the information that demonstrates compliance—or face the prospect of penalties.

-

Solution:

Solutions that facilitate compliance with financial, security, and privacy regulations ease the burden on financial leaders. Cloud-based applications, in particular, that continuously update content as new security threats emerge decrease the risk of sensitive consumer data being compromised. In addition, leading applications automatically update to comply with changes to applicable accounting and tax rules. They also automatically create audit trails that ensure that every transaction is logged, making it easier to trace the origin of any problems.

Savvy financial institutions are also exploring generative AI for assistance with managing regulatory compliance, financial, and cyber risks. For example, companies are training AI tools to answer questions about regulatory changes, generate suspicious-activity reports, evaluate credit risk, and analyze the organization’s cybersecurity readiness. Of course, the systems themselves must be secure. Data stored in spreadsheets with easy-to-guess passwords is far less secure than information stored in an enterprise system that encrypts sensitive data, enforces strong passwords, and limits access only to people with the appropriate roles and authorizations.

4. There’s Too Much Data to Maintain and Report On

As previously mentioned, financial services companies have access to an ever-growing volume of data from internal and external sources. The good news is, more data helps businesses better analyze customer preferences and behaviors, assess lending risks, spot patterns associated with fraudulent activities, and create precisely tailored products. But so much big data also presents big challenges: There’s more information to organize, manage, and secure, calling for tools that are capable of analyzing vast amounts of data—without requiring a correspondingly enormous amount of manual effort. Compounding the challenge, today’s information sources aren’t restricted to structured tabular data; marketers, for example, may need to analyze unstructured data from social media posts.

-

Solution:

Over the past few years, cloud-based tools have brought big-data analysis within the reach of small to midsize financial services providers. Cloud-based data warehouses specifically designed to facilitate analyses and reporting can store enormous amounts of tabular data without the need to build and maintain expensive IT infrastructure. Data lakes add the ability to store and analyze unstructured data, such as text. In addition to conventional analytics tools, businesses can use AI to automate the process of finding useful patterns in data, uncovering valuable trends in customer behavior, and identifying dangerous threats, such as fraud.

5. It Takes Too Long to Organize and Format My Reports

Financial services companies are required to produce a variety of timely reports to meet regulatory requirements, communicate with investors and stakeholders, and support internal analyses and decision-making. In practice, generating reports is often an onerous and overly long process: Sometimes data needs to be manually pulled from multiple systems and then consolidated and reformatted for each report, which is tedious and error-prone. Applications may provide limited, inflexible reporting capabilities, so extra work is required to generate the reports the business needs. Among the consequences, reporting delays can result in missed deadlines that result in reputational damage and increased regulatory scrutiny, as well as an inability to spot trends and issues early on, leading to expensive losses and missed opportunities.

-

Solution:

Integrating business data into a system with real-time reporting capabilities can make reporting faster, more automated, and more accurate. Software suites that include accounting and finance applications meld business data into a central database, reducing or eliminating the need to extract and reformat data so it can be used. Built-in reporting and analytics tools provide up-to-the-minute views of financial data and business performance, enabling the company to quickly meet statutory reporting requirements.

For cases where reporting requires data from a wider range of sources, centralized data warehouses can be used to consolidate information for analysis. Building and updating a data warehouse can involve a considerable amount of work, and the steps required to import data mean that the information in the warehouse isn’t always completely up to date. But once it’s up and running, the warehouse can support deep analyses and complex reporting that might not otherwise be possible. Of note, a cloud-based solution can streamline this process, resulting in greater financial efficiency.

6. Someone Else Needs to Help Me Get the Data I Need

CFOs and analysts require access to data from multiple departments and functions within the company in order to build a comprehensive, accurate picture of financial performance. But at many companies, data is stored in systems that lack self-service analytics tools and require staff with specialized expertise to extract it. Some data may be locked away in departmental applications that store data in proprietary formats, again necessitating the help of departmental or IT staff to gather and combine it with other information for analysis. Each manual step adds time and costs, as well as consuming staff resources that could be better applied to more productive tasks.

-

Solution:

User-friendly analytics tools that enable self-service analysis and reporting let financial specialists quickly pull and analyze data from multiple sources without having to wait for someone else to intervene. An alternative approach for data needed on a regular basis is for the organization to develop tools that automatically extract the details from each source. For a long-term solution that enables flexible, ad hoc analysis and reporting based on the organization’s evolving needs, consider deploying an integrated set of applications that stores the data in a centralized database and provides tools that nonspecialists can use to generate reports and explore trends and exceptions.

7. There Are Too Many Organizational Silos

It’s hard to get a complete picture of the organization’s financial performance and health when data is scattered across departments and business units. Siloed information can also make it difficult to quickly determine whether to lend money to a customer. The problem is particularly common in the financial services sector because many companies grow through mergers and acquisitions and, as a result, inherit a mixture of incompatible systems. But there are also other reasons why organizational data silos exist. Within banks, for example, departments that manage lending, investments, and consumer banking may each have their own system designed to support their particular specialized needs. Some companies support corporate functions with older IT systems that don’t communicate with the newer applications brought in to support evolving business requirements. Sometimes, unfortunately, departments are simply reluctant to share data because they view it as a source of power that gives them an advantage over other groups within the organization.

-

Solution:

Analyzing data from across the business fortifies business decisions and improves overall financial performance; everyone benefits. Establishing a culture of data sharing can help break down departmental barriers, reinforced by creating clear guidelines for consistent data quality and data access across departments. Technical barriers erected by incompatible systems and data formats may also need to be dismantled. A variety of technology approaches can be used to ensure that data is readily accessible across the organization to financial specialists and others who need it, starting with cross-platform reporting and data extraction tools and extending to integrated cloud-based business application suites that combine data into a single, secure database. Fine-grained, role-based access control can assuage departmental concerns by ensuring that only people with the appropriate authorization can access the data needed to perform their jobs.

8. Our Needs Have Outgrown Our Software Suite

Many businesses start out with applications that provide a limited set of functions designed to support small-company needs. For example, they may use small-business accounting and payroll software to manage their finances, relying on standalone spreadsheets for analyses that those applications can’t handle. But as businesses grow, their needs typically outgrow the capabilities of those basic applications. For example, sophisticated analytics and reporting capabilities that help track and manage increasingly complex business operations in real time may become necessary. Expanding companies, finding themselves faced with handling bigger transaction volumes, benefit from a broader set of applications that supports expanding operational needs, sometimes including support for multiple entities or international operations.

-

Solution:

When an existing software suite becomes an obstacle to a company’s growth and its ability to operate efficiently, it’s time to deploy a more capable solution that can support current and future needs. Consider a modern, cloud-based financial system that provides multi-entity capabilities, advanced analytics and reporting, and support for multiple currencies and jurisdictions. Cloud-based solutions are automatically updated, reducing the need for IT expertise and ensuring that the software stays current with evolving accounting standards and financial regulations. These solutions can also scale as your organization grows, without requiring expensive and time-consuming hardware upgrades. Some software suites combine financial management with other applications that help manage almost every aspect of operations. Because all data is stored in a central database, finance specialists gain visibility into processes and performance across the entire business.

How Does ERP Software Empower Data Decision-Making?

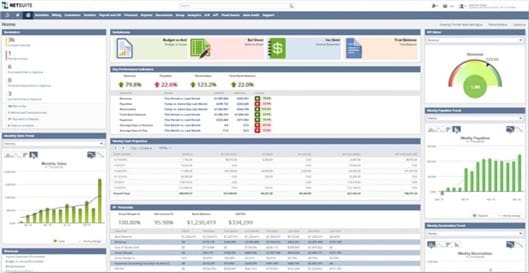

To stay competitive in fast-moving financial services industries, businesses need to be able to quickly make decisions based on timely, accurate data. NetSuite ERP empowers data-driven decision-making through a set of applications that integrates data drawn from across the business into a single database. As part of this cloud-based, AI-powered suite for managing practically every aspect of the business, NetSuite Financial Management provides real-time visibility into financial performance, including a consolidated view of operations and detailed insights into individual transactions as well as potential issues. Finance specialists and business leaders can use built-in reporting and analytics capabilities to analyze business performance, facilitating faster, more informed decisions. Role-based dashboards help track key finance performance indicators and quickly spot both emerging problems and trends. By automating core accounting functions, NetSuite helps businesses accelerate financial close processes, produce accurate financial forecasts, comply with accounting standards and reduce the likelihood of accounting errors.

Because financial services rely so heavily on accurate, timely data, missing, unreliable, or siloed data presents a significant barrier to operational efficiency, regulatory compliance, risk management, and the ability to create compelling new products. Fortunately, there are ways to overcome such challenges. In addition to establishing a data-sharing culture and companywide data standards, financial services firms can take advantage of modern financial and ERP systems and analytics tools that support faster, more accurate reporting and analysis, helping them remain competitive in a fast-changing industry.

Data Challenges in Finance FAQs

What are the biggest challenges in ensuring data quality?

In financial services, the biggest challenges to ensuring data quality are a lack of data standards, reliance on manual data entry, and siloed organizational systems. Approaches to overcoming those issues include setting and enforcing data standards and moving to an integrated application suite that stores business data in a central database.

How is big data changing the finance industry?

Big data is radically changing the finance industry. Financial services companies can use artificial intelligence, as well as more conventional analytics tools, to spot patterns within vast amounts of transactional, market, and customer data that, in turn, can help them create better products and detect fraudulent activities, among other advantages.