We detail the most vital compensation metrics, how to calculate them and how to use the results to improve compensation effectiveness.

Inside this article:

What Are Compensation Metrics?

Compensation metrics are measurements of employee pay programs, including both monetary and non-monetary pieces. These metrics reveal the success and problem areas of compensation. Companies will better understand pay distribution and have the data to make intelligent decisions.

Key Takeaways

- It is critical to monitor your overall compa, or comparison, ratio and break it down by tenure, job role, gender and ethnicity.

- Review your salary band adherence by tenure to ensure competitive and fair pay for long-term employees.

- To retain employees and adhere to your compensation strategy, you must regularly monitor both your green circle rates — salaries that fall below the minimum salary band — and red circle rates — salaries that are higher than the maximum rate in a salary band.

Why Should You Track Compensation Metrics?

You should track compensation metrics because they are an essential element of business success. These metrics help HR teams determine if compensation is meeting company and employee needs.

It is essential for compensation packages that include monetary and non-monetary benefits and incentive compensation to align with your business goals. Additionally, compensation must be fair and competitive to attract and retain talent: Salary (67%) and benefits (63%) are the most important to job seekers. Monitoring compensation metrics and key performance indicators (KPIs) helps you set pay rates, develop salary ranges, measure fairness, prevent legal issues, remain competitive and retain employees.

Additionally, recruiting metrics and talent management KPIs often go hand in hand with compensation metrics.

Turn Your Compensation Data Into Action

Top Compensation Metrics and KPI Examples

Below we will look at the most crucial compensation metrics. We will explore more than 40 metrics, from pay range to salary bands and differentials.

Pay Range

Pay range is the minimum, midpoint and maximum pay boundary for a specific role. This is a key HR compensation plan metric or analytic that helps determine appropriate employee pay.

Pay range = minimum salary, mid-point salary, maximum salary

Pay Range Minimum

The pay range minimum is the lowest salary or pay for a particular role. Depending on the organization or industry, this pay may be up to 20% lower than the midpoint pay.

Pay Range Maximum

The pay range maximum is the highest salary or pay for a particular role. This pay may be up to 20% higher than the midpoint pay depending on the organization or industry.

Pay Range Midpoint

The pay range midpoint is the middle point between the pay range maximum and minimum. This represents the fair and competitive rate for a specific role. Paying below the midpoint leaves the company open to high turnover.

Pay range midpoint = minimum salary + maximum salary / 2

Pay Range Width or Spread

The pay range spread is the percentage difference between the minimum salary and the maximum salary. This metric determines the breadth of the salary range.

Pay range spread = maximum salary - minimum salary / minimum salary x 100

Salary Differential

A salary differential is additional pay for skills, coursework, situations or working conditions. For example, an employee may receive a pay differential for working the night shift. In the formula below, the differential is 10%.

Pay differential = base pay x

differential

$1.5 = $15 per hour x .10

Salary Band Metrics

Salary band metrics define the standard pay range for each job role. These metrics help identify employees who are over and under their salary bands.

Percent of Employees Below Salary Band or Over Range

It is not uncommon for employees to fall below the salary band. This metric helps companies stay ahead of employees leaving for higher-paying positions.

Percent of employees below salary band = number of employees below salary band / total number of employees x 100

Percent of Employees Over Salary Band

Employees over the salary band may require promotion consideration. If an employee has exceeded the earnings of the current job role, consider a new position that accommodates the person’s skills and compensation expectations.

Percent of employees over salary band = number of employees over salary band / total number of employees x 100

Salary Band Adherence by Tenure

Sometimes new employees will earn more compensation than their longer-tenured colleagues. It is crucial to monitor your tenured employees’ salaries to ensure competitive and fair pay.

One way to monitor this is to look at the percentage of employees below, in and above band based on tenure. The example below demonstrates this metric.

Percentage of employees below band = number of employees below band / total number of employees x 100

Percentage of employees in band = number of employees in band / total number of employees x 100

Percentage of employees above band = number of employees above band / total number of employees x 100

For example, let’s say a company has a total of 10 sales representatives, and the salary band for their role is $60,000 to $90,000, with their tenure as follows:

<1 year tenure = 2 employees

1-2 years tenure = 6 employees

2-3 years tenure = 2 employees

Employee salaries for each tenure category are as follows:

<1 year tenure = $55,000, $$65,000

1-2 years tenure = $60,000, $62,000, $70,000, $80,000, $95,000, $95,000

2-3 years tenure = $92,000, $95,000

The percentage of employees below, in and above band for each tenure category are as

follows:

<1-year tenure:

Percentage of employees below band = 50%

Percentage of employees in band =

50%

1-2 years tenure:

Percentage of employees in band =

66.6%

Percentage of employees above band =

33.3%

2-3 years tenure:

Percentage of employees above band =

100%

Green Circle Rate

A green circle rate refers to any salary that falls below the minimum salary band. Promotions and changes in pay ranges without increasing employee salaries contribute to green circle rates. All employees below band are green circle rates.

Red Circle Rate

A red circle rate is when an employee’s compensation is higher than the maximum rate in a salary band. Demotions in role without decreasing pay may cause red circle rates. All employees above band are considered red circle rates.

Functions Above or Below Salary Band

Monitoring the market rate is essential to remain competitive. For example, if your salary band for a role is $50,000 to $80,000, but the market rate is $90,000, the function is above your band. Adjustments to your salary band are necessary to remain competitive.

Pay Grade Inflation

Pay grade inflation often occurs in government agencies. The pay grades (or salaries) continue to increase while the employee’s role remains the same. This change is a result of guaranteed annual pay increases.

Compa Ratio

The compa, or comparison, ratio is a metric that compares an employee’s salary to the midpoint market salary for the role. A compa ratio at the exact midpoint is 100%.

Compa ratio = employee salary / pay range midpoint x 100

It is important to monitor the overall compa ratio. Breaking it down by tenure, job role, gender and ethnicity provides valuable insight into where you may compensate too low and risk losing quality staff or compensate too high and risk your profit.

Average Salary by Gender

Average salary by gender will help you uncover valuable details about the pay of women vs. men in your company. It is possible to find pay disparity by monitoring salary across subgroups.

Average salary for women = total annual

salary for all female employees / total number of female employees

Average salary for men = total annual

salary for all male employees / total number of male employees

The compa ratio breakdown by gender will tell you how your female and male employee salaries compare to the average market salary.

Wage Gap

Uncover a gender wage gap by using the average salary by gender metric. The first step is to identify the median salary for women and compare it to the median salary for men.

Wage gap = 100% - (average salary for women / average salary for men) x 100

Average Salary by Ethnicity

The average salary by ethnicity will help identify pay gaps across ethnicities. The wage gap metric is useful for identifying disparity across ethnic groups. The higher the percentage, the larger the pay gap.

Average salary for by ethnicity = total annual salary for all (insert ethnicity) employees / total number of (insert ethnicity) employees

Perform this calculation for each ethnicity in your organization and compare results to determine if pay is commensurate across ethnic groups, across the entire organization or in a particular role.

Salary Range Penetration

Salary range penetration determines how far into a salary range an employee is. For example, if Keith’s pay is $100,000, and his salary range is $85,000 - $119,000, then his salary range penetration is 44%.

Salary range penetration = (salary - range minimum) / (range maximum - range minimum) x 100

Target Percentile

The midpoint in a pay range is the target pay level for a role. You can use the salary range penetration formula above to identify employees above or below the midpoint. The ideal salary range is 50%.

Geographic Differentials

A geographic differential is a pay adjustment based on location. These geographic differentials are typically due to the cost of labor or cost of living. In the example below, the differential is 10%.

Geographic differential = base pay x

differential

$8,000 = $80,000 per year x .10

Market Index

The market index compares an employee’s salary to the industry average for that role. You can also compare the average pay of your employees to the average market rate to gather an overall market index.

Market index = average employee salary - average market rate / average market rate

Market Ratio

The market ratio indicates the average market rate for each role relative to your internal salary midpoint. If the rates are similar, you likely offer a competitive salary.

Market ratio = average internal rate / average market rate x 100

Compensation Cost

Compensation cost is a metric that measures the total cost of all compensation for an organization.

Compensation cost = sum (total compensation cost for all employees)

Compensation Revenue Factor

The compensation revenue factor shows employee pay in relation to revenue. Employee compensation is one of a company’s largest expenses, and monitoring this metric might be key to your company’s financial health and prospects.

Compensation revenue factor = total employee compensation / revenue

Bonus Pay Percent

Bonus pay percent is the total of all annual bonus pay in relation to total yearly base pay. This number is demonstrated as a percentage.

Bonus pay percent = total bonus pay / total base pay

Percentage of People Promoted

The percentage of people that receive a promotion is the promotion rate and typically presents for a specific time frame.

Percentage of people promoted = total number of promotions / total number of employees x 100

Average Promotional Increase

The average promotional increase is the average pay raise given for a job promotion.

Average promotional increase = total of all promotion increases / number of promotions

Employee Equity Vesting Percentage

It is common for companies to vest stock options across multiple years. For example, if an employee is on a four-year graded vesting schedule, the stock options vest in 25% increments.

Employee equity vesting percentage per year = 100% / graded schedule years

Annualized Salary

Annualized salary budgets are for full-time employees that do not work the entire year, and part-time and hourly workers. For example, a teacher’s annualized salary ensures pay over the whole year instead of only the 10-month school session.

Annualized salary = monthly wage x 12

Annualized salary differs from annual salary. The annual salary is the entire yearly income for the year. The annualized salary is an estimated annual salary based on the time spent working.

Full-Time Employee Equivalents (FTE)

Full-time employees typically average 30 hours or more per week in a month. There are two steps to calculating FTE: identifying the total number of full-time employees and calculating the full-time equivalents of part-time employees.

FTE in part-time workforce = total hours

worked by part-time employees in a month / 120

FTE = total FTE in part-time workforce +

total number of full-time employees

Planned Headcount vs. Actual Headcount

Headcount represents the number of people employed at a given time. Comparing actual headcount to planned headcount can help identify gaps in the organization structure.

Actual headcount = the actual number of

existing employees in a given time period

Planned headcount = the intended number

of employees in a given time period

Planned Compensation vs. Actual Compensation

It is essential to pay valued employees a market wage. Developing a compensation plan will help budget for top talent and employee growth. Comparing your planned to actual compensation may demonstrate areas where you are over or underpaying employees.

Planned compensation = the intended

compensation for all employees in a given time period

Actual compensation = total pay for all

employees in a given time period

Average Number of Employees

Total average number of employees is the average number of employees on staff during a given time frame.

Average number of employees = total number of employees at the beginning of the time period + total number of employees at the end of the time period / 2

Employee Turnover Rate

Turnover rate is an essential metric for understanding your organization. It indicates the number of employees who leave during a given time period. A low turnover rate suggests that employees are content at work, while a high turnover rate indicates problems.

Turnover rates must be viewed in context, as certain industries, such as hospitality and retail, traditionally have higher than average employee churn. A company can and should benchmark its turnover rate across similar businesses in its industry to get a sense of how well it’s retaining talent. Voluntary resignations, terminations and retirements are all included in the number of employee departures.

Turnover rate = total number of employees that leave during a given time period / total average number of employees x 100

Most studies of the causes of high voluntary turnover agree that more money and time off, better benefits, a promotion and the prospect of a more supportive boss are the top 5 reasons good employees decamp to new positions.

Benefits Spend Rate

Employee benefits are the non-wage portion of employee compensation. Holiday pay, healthcare, bonus, vacation, pensions and stock options are all benefits. The benefits spend rate is the percentage of compensation allocated to benefits.

Benefits spend rate = total benefits spent / total compensation spend x 100

Annual Benefit Spend Change

The annual benefit spend change is the total spend for benefits in the current year compared to the previous year. This number is an important compensation and benefit KPI that presents the year-over-year percentage change.

Annual benefit spend change = current year benefit spend - previous year benefit spend / previous year benefit spend x 100

How Do You Measure Compensation Effectiveness?

Collecting and reviewing compensation data is the best way to measure the effectiveness of your program. The compensation scorecard will provide key measurements, help leaders identify problems and provide the data to make solid decisions.

HR analytics depends on quality of your HR metrics.

What Is a Compensation Scorecard?

A compensation scorecard is a central display of select compensation metrics. The scorecard provides visibility into your companywide or smaller reporting group compensation. Scorecards help pinpoint problems and arm you with the data to make adjustments when necessary.

List of Most Common Compensation Scorecard Metrics

A compensation scorecard aligns directly with business goals. It will include a variety of metrics based on growth, financial or strategic plans. Metrics within the scorecard will vary by organization but may include:

- Compa ratio

- Average promotional increase

- Pay range midpoint

- Grade inflation

- Market ratio

- Percent of employees over salary range

- Percent of employees under salary range

- Employee turnover rate

- Average salary by ethnicity and gender

- Wage gap

- Red circle rate

- Green circle rate

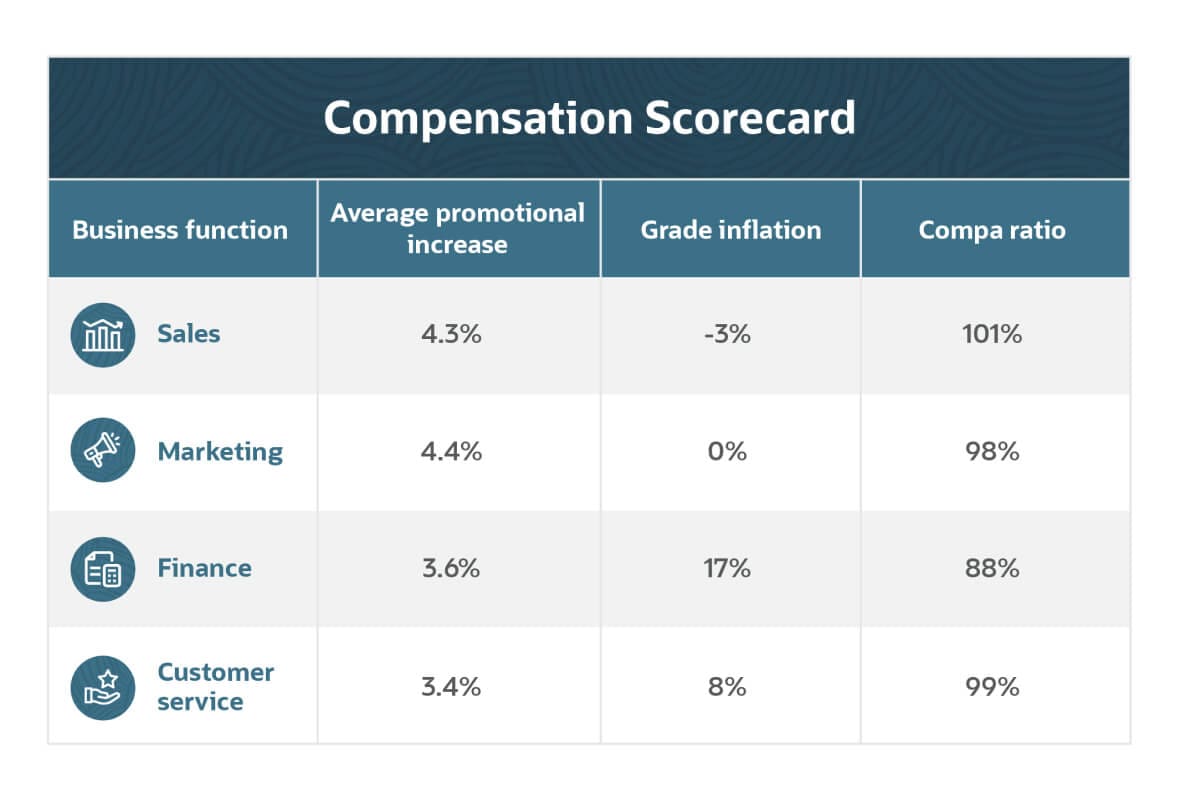

The compensation scorecard will look at one or more metrics. For example, this scorecard sample compares compensation across business departments. The compa ratio for the finance department indicates that employees are underpaid and at risk of leaving.

What Is a Compensation Dashboard?

A compensation dashboard is a graphical display of real-time compensation metrics. A dashboard reduces the need for multiple reports. It helps gauge the effectiveness of compensation across the entire organization, roles, regions or business units.

HR managers will use a compensation dashboard to get a digestible view of current compensation spend, regional spend, headcount and turnover rate.

- Total compensation cost

- Compensation by region

- Planned headcount vs. actual headcount

- Turnover rate

How to Get Started With Compensation Metrics?

Getting started with compensation metrics involves more than just knowing the measurements. You must understand business goals and identify metrics that align with them. For example, if your turnover rate is high, perhaps your pay is not competitive.

It’s a good practice to establish a baseline — internal or external — for comparisons. In the example above, it’s essential to understand the market rate for the roles in your organization. Your external baseline may be the average pay at competitive organizations. You will use this baseline to compare your pay rates and ensure competitiveness.

It is also important to remember that metrics do not always paint the whole picture. But metrics may lead you to question your compensation strategy, discover what practices are working well or highlight problem areas.

To get started, define your business goals and measurable compensation metrics. Once that’s set up, you’ll want to monitor metrics in a dashboard, review metrics weekly and ask questions. Be sure to share results with the appropriate leaders so you can make changes where necessary.

How a Human Capital Management Solution Helps With Tracking Compensation Metrics

HR leaders are responsible for an abundance of functions, from recruiting to training, payroll, compensation, and performance management. Organizations are increasingly interested in streamlining their operations with consolidated solutions while improving employee recruiting and retention. A human capital management (HCM) system is a valuable tool for managing metrics and other HR activities.

A robust HCM solution can handle everything from tracking real-time metrics in an easy-to-view dashboard to onboarding new employees. Keeping all data in a central location means HR professionals can easily analyze their metrics. This information provides valuable insights into compensation spending, from pay to benefits, that may be used to inform the overall compensation strategy.

The system can also serve as a portal for employees to request time-off, access org charts and set work goals.

NetSuite’s SuitePeople Provides a Centralized Solution for HR Leaders

NetSuite has a deep understanding of HR challenges and how real-time metrics can influence a company’s compensation strategy. NetSuite SuitePeople weaves personnel data throughout the suite of solutions, arming leaders with the data they need to make intelligent decisions about incentive compensation management and overall benefits packages.

Real-time people analytics through an HCM solution allows managers to monitor and analyze compensation details for true transparency into compensation effectiveness.