What is NetSuite Intelligent Payment Automation?

NetSuite Intelligent Payment Automation provides a fast, efficient, and simple way to make vendor payments directly from NetSuite. Self-service onboarding and setup get you live quickly so you can accelerate accounts payable processes, increase efficiency, and help reduce risk. The result: tighter control of outgoing cash and scalable, end-to-end AP.

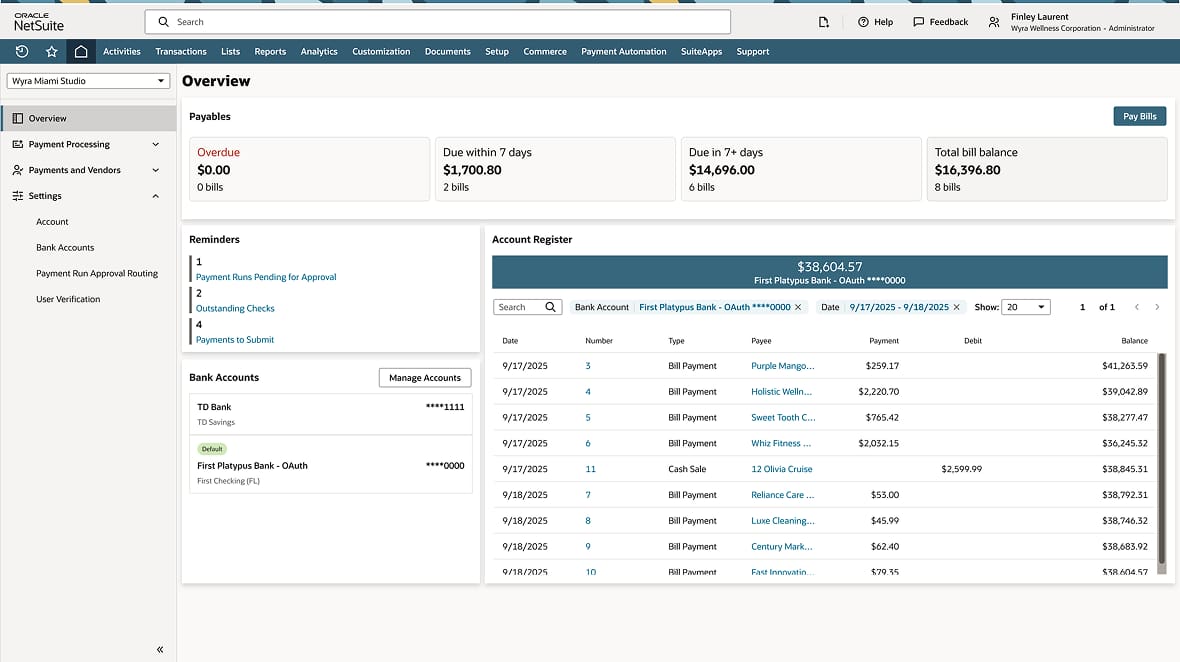

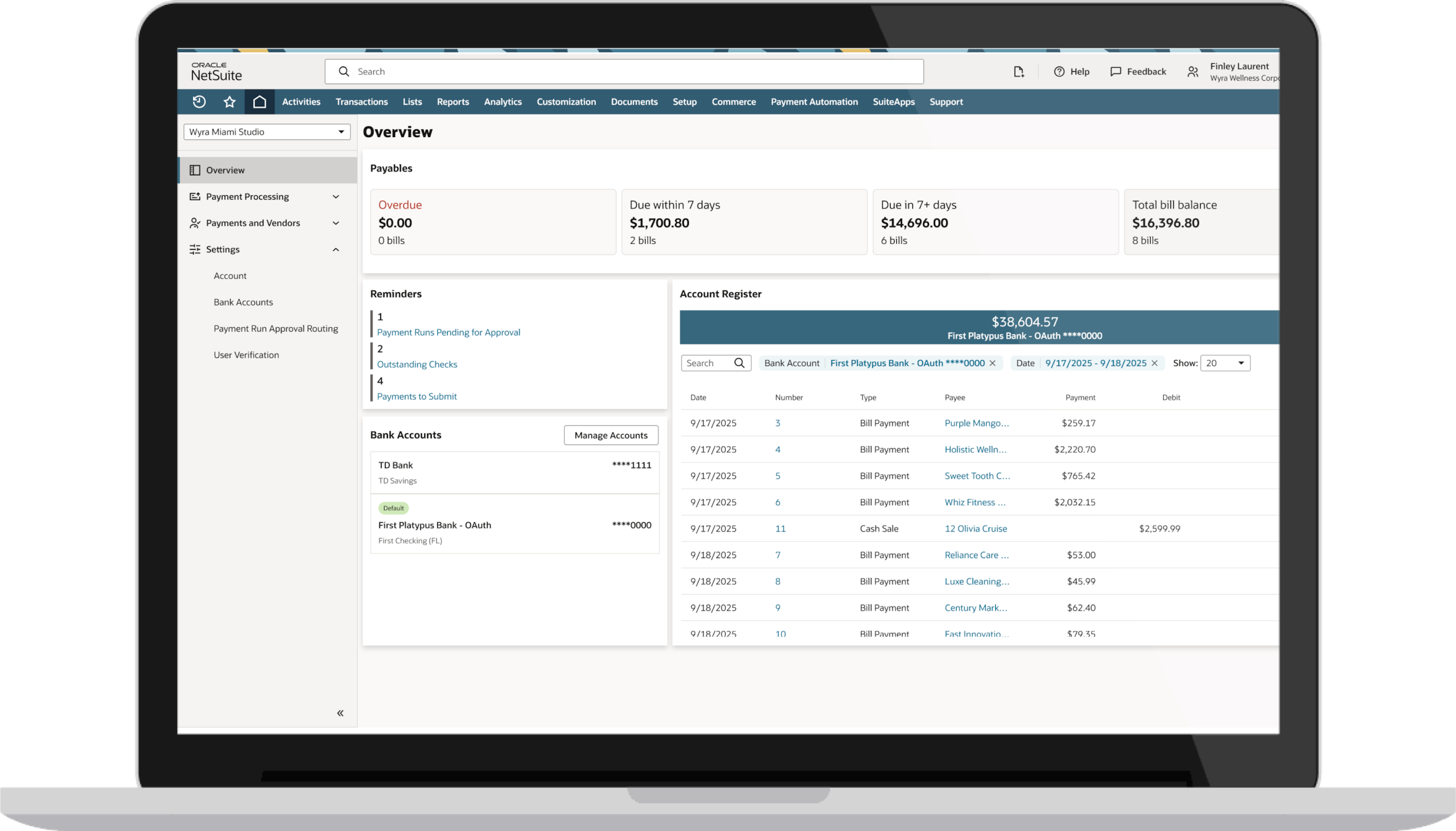

Pay invoices directly from NetSuite

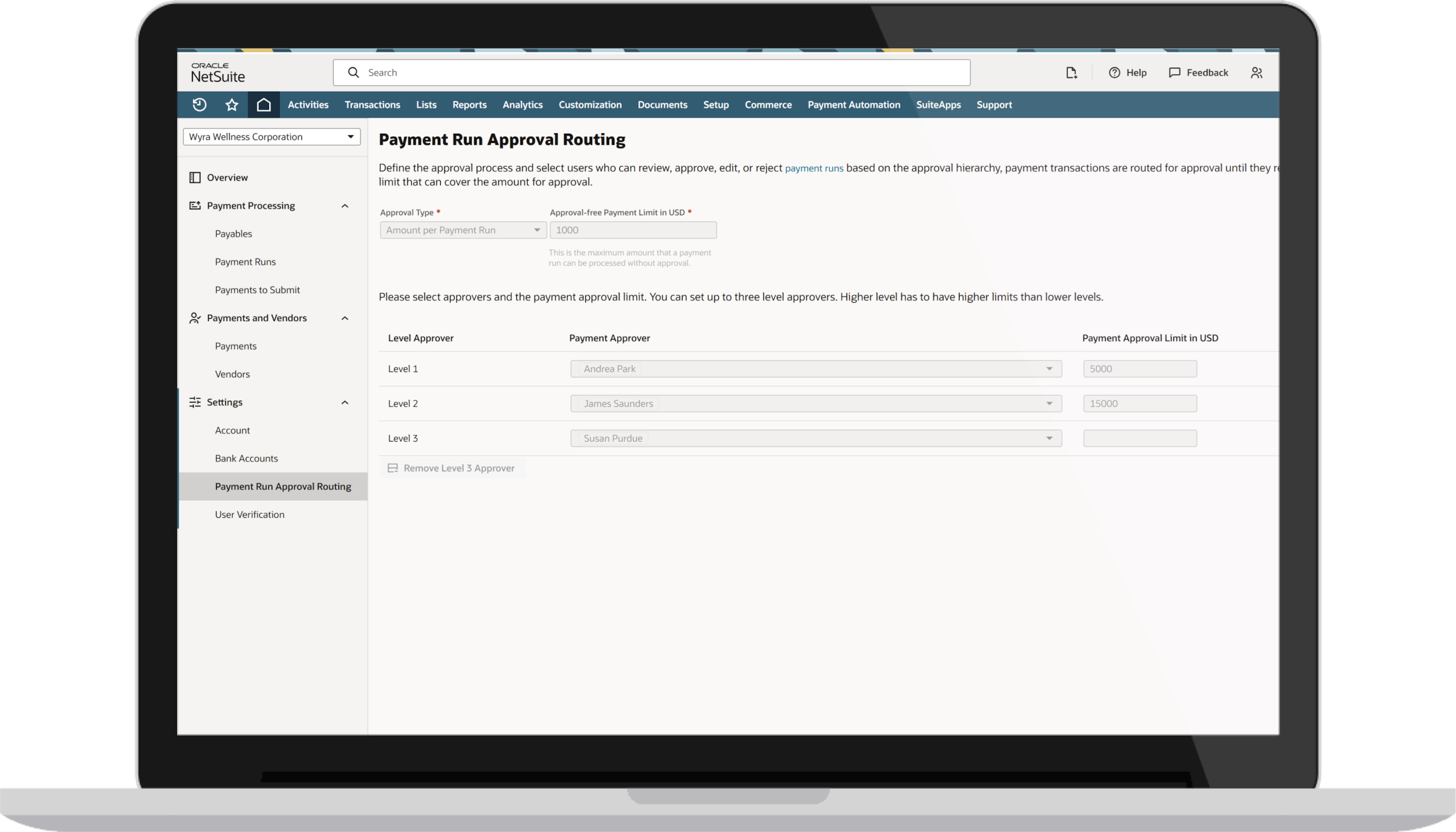

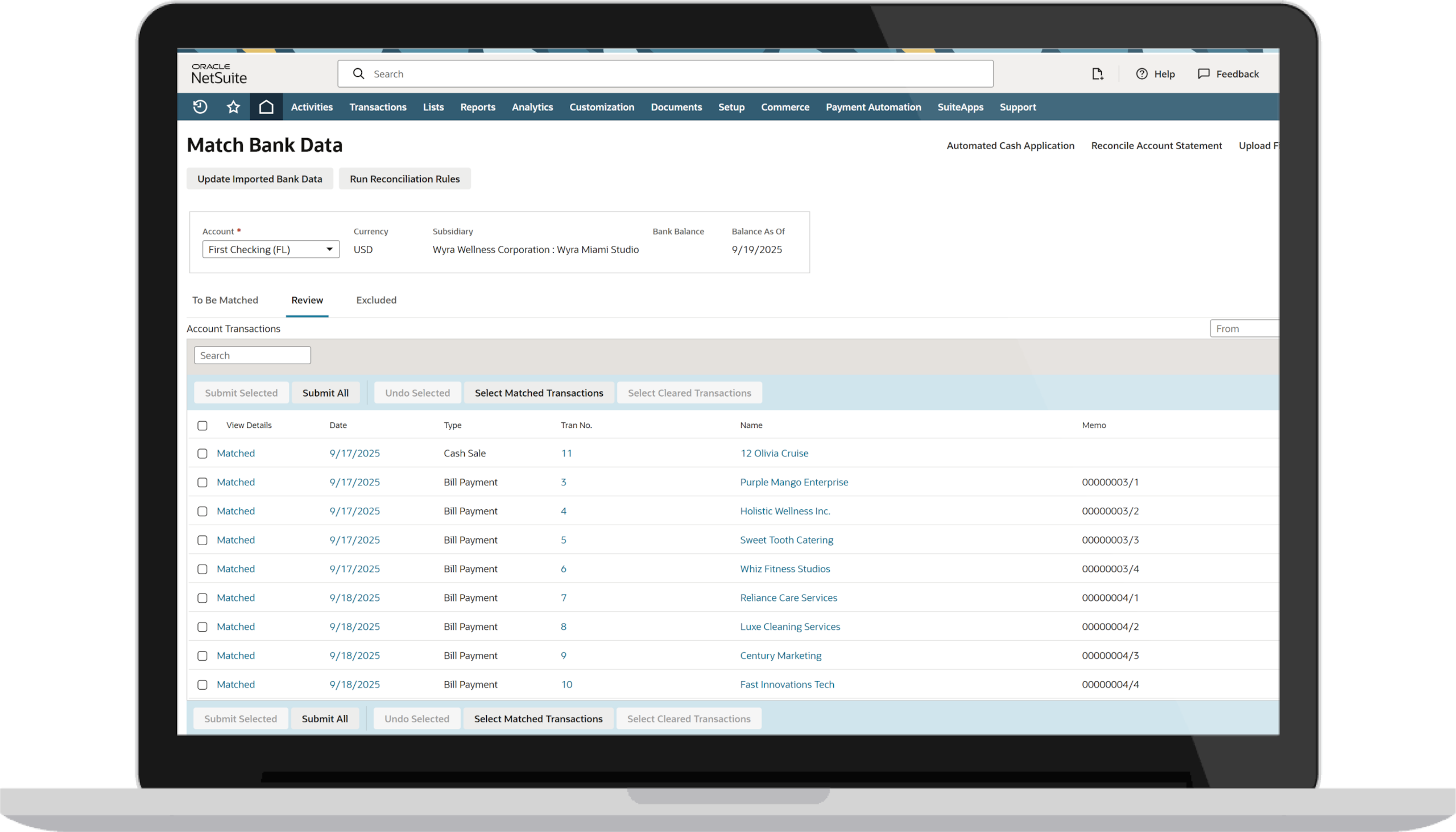

Automate processes and gain greater control

Embedded payment automation lets you pay vendors directly within NetSuite using BILL. Approval routing, status tracking, and automated GL entries boost visibility and improve cash flow management.

NetSuite Intelligent Payment Automation benefits

Challenges NetSuite Intelligent Payment Automation solves

How much does NetSuite Intelligent Payment Automation cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

NetSuite Intelligent Payment Automation is a no charge add-on module.

Contact NetSuite Now(opens in new tab)