Many entrepreneurs think of their businesses as extensions of themselves. It’s a very human instinct given that every company springs from an idea, nurtured by talent and hard work. But as an owner, failing to separate business and personal finances is a mistake that can be costly for both you and your company.

Establishing business credit is a firewall against certain financial and tax liabilities in that it helps establish that you and your business are separate legal entities. Business credit may also open opportunities by making your company eligible to borrow higher amounts of money and avoid having to prepay for supplies.

However, it can be tricky for startups and small firms to establish business credit. Many lenders want owners to take personal responsibility for repaying debt. Further, business accounts often do not carry the same protections from theft, fraud and cybercrime as consumer accounts do. While there are upsides to business accounts, such as attractive rewards programs for business credit cards that beat what consumer cards offer, the lure of better security entices many small-business owners to use personal credit cards and bank accounts for their companies.

That may seem like a low-risk decision, but the fact is, it introduces financial perils and borrowing obstacles and may inhibit growth.

What Is Business Credit?

Extended business credit is to be used for strictly business purposes. In other words, the business owner cannot use the credit to pay for personal expenses or items.

Business credit is available in many forms, including credit cards, loans and lines of credit to cover routine expenses or fund growth initiatives. Lines of credit are typically used to cover operational expenses, not to purchase assets. Ideally, a credit card would be used for the same purpose but might be used to purchase lower-cost assets, like computers and office equipment.

Like personal credit, business credit is rated or scored by risk firms such as Experian, TransUnion and Equifax. But there are additional niche business risk rating agencies too, such as Dun & Bradstreet, and a variety of specialty business credit reports.

Personal vs. business credit

Personal and business credit are subject to different regulations, lender policies and protections. When personal and business credit are fully separated, any disputes or negative notes on one are unlikely to affect the other.

However, be aware that some lenders and credit issuers may ask for or require a personal guarantee of repayment. That re-entangles business and personal finances, so avoid these arrangements if possible.

Key Takeaways

- Keeping personal and business accounts separate increases the borrowing power and protects the credit scores of each entity. Bad personal credit can reduce business borrowing power, but separating the two won't necessarily improve the individual's credit rating.

- Periodically check to see if a credit file exists on your company at one or more business credit reporting agencies — and ensure any details are accurate.

- Pay debts on time and in full to maintain good credit standing and safeguard your access to loans. Such funding is critical to seize opportunities that arise unexpectedly or in cases where cash flow is interrupted.

Business Credit Explained

Business, like personal, credit is built by developing a consistent payment history over time. Most small businesses start with a business credit card and credit with vendors; but buying from a vendor on credit isn't the same thing as a line of credit.

A line of credit is a set amount of money provided by a bank or other financial institution to be used if and as needed. Companies must repay funds used from the line of credit plus interest fees. Vendors don't charge interest, though they can charge late fees. Credit scoring is used, sometimes in combination with other data, to help financial organizations and investors determine risk.

Personal accounts and credit scores do not help build the business’ credit score, although some lenders may incorporate the owner’s personal credit score in their risk assessment algorithms prior to making a lending judgment.

Still, the effort to attain credit is well worthwhile because it can be difficult to cover month-to-month costs in a small business without that access — in fact, limited or inconsistent cash flow is a perennial financial challenge.

12 Steps to Build Business Credit

Building business credit takes time, but there are several critical steps that can help — some of them more important than others, some of them quicker and easier than others. Here’s a helpful checklist.

Review this list of steps to determine which ones you can begin immediately, which can be done concurrently and which you should begin preparing for.

-

Establish your business as a separate entity:

Build and maintain boundaries between your personal and business accounts. The best starting point is to establish your business legally in such a fashion that it is clearly an ongoing enterprise.

First, consult with your attorney or accountant to see which legal business classification is best for your purposes. Here are the tax pros and cons of various structures.

What are the tax pros and cons of each business structure?

Business structure Tax pros Tax cons Sole proprietorship - Pass-through entity

- Easy/inexpensive business structure to set up

- Minimal reporting requirements

- No corporate business taxes

- Unlimited personal liability

- Difficult to get business financing

- No perpetual existence

Partnership - Pass-through entity

- No corporate business taxes

- Easy/inexpensive business structure to set up

- Unlimited personal liability (depending on partnership classification)

- No perpetual existence

- Must create an official partnership agreement (opens in a new tab)

Limited liability company (LLC) - Limited liability

- Flexible management structure

- No corporate business taxes

- Flexibility to choose tax structure

- Not recognized outside the U.S.

- No perpetual existence

- Not recognized on a federal level—dictated by state statute

C corporation - Limited liability

- Unlimited number of shareholders

- Preferred for IPO and outside investors

- Perpetual existence

- Double taxation

- More difficult and expensive to start

- Increased regulation and oversight

S corporation - Limited liability

- Pass-through entity

- Perpetual existence

- No corporate business taxes

- Only 100 shareholders permitted

- Strict qualification standards

- Only recognized inside the U.S.

- Not recognized by all states

From a finance-separation standpoint, a C corporation is a legal structure forming an incorporated entity that is itself subject to corporate income taxes; its owners or shareholders are taxed separately. In contrast, an S corporation passes business income, losses and credits through to its shareholders for federal tax purposes.

A limited liability company (LLC) is a business structure created by state statute, and therefore regulations may differ based on where the company is headquartered. But in general, in an LLC, the owners are protected from much of the company’s liabilities, but profits and losses pass through to the owners for tax purposes. Some industries, such as banks and insurance companies, are barred from using the LLC structure. A limited liability partnership (LLP) is a business structure that spreads risk among partners, thus limiting the exposure of each partner according to the amount of their contributions to the company.

Note that even if you operate as a nonprofit or not-for-profit, you must set up a structure.

-

Get an EIN from the IRS:

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number. An EIN is used to identify a business entity for tax purposes and is often required when a business applies for a loan or other credit. Get one by applying for it with the IRS. If you apply online, you can usually get your EIN issued immediately.

-

Open a business bank account:

It is imperative that personal and business funds not be commingled. Separate business funds by establishing a business checking account. Your company may pay owners and stockholders from this account as it would any other expense, but no checks for personal items should ever be written from a business account.

-

Establish a business address and phone number:

Even if it is a home-based business, having a listed street address and phone number helps define the company as a concrete entity.

You can create phone numbers and fax numbers online through business phone services, such as Ooma, GoToConnect and Nextiva, that provide dedicated business numbers and collaboration apps without having to invest in hardware or traditional phone services. Some smartphones can also be partitioned for two phone numbers — a personal and a business number will work on the same device. And of course, you’ll want a dedicated business email.

-

Apply for a Dun & Bradstreet D-U-N-S number:

This is a unique nine-digit identifier for businesses that’s issued by the Dun & Bradstreet credit reporting agency. Applying for a D-U-N-S number will start a business credit file or clarify the identity of your company in an existing credit file. Further, it will help your company qualify for certain new business opportunities, such as government contracts.

-

Use a company credit card:

A common way to establish business credit is by getting a credit card issued to the company. If you have an existing relationship with a bank, you may find it easier to get a business credit card without a personal guarantee there. Remember, you want the account to be solely a business account.

Shop business credit cards to find the best terms and to learn whether they require a personal guarantee. Next, consider features and rewards programs that you can leverage, and decide whether you will want to issue cards to employees to make expense tracking easier.

-

Make payments on time, all the time:

The entire point of a credit history is to establish your future creditworthiness and reliability as a company. Everything hinges on your company making payments on time and as agreed. Any deviations regardless of cause such as slow payments, partial payments, or no payments can damage your company’s financial health for years.

-

Work with vendors that report payments:

Next, establish credit with a supplier or vendor that reports payments to credit agencies. If you are a startup, you may have to begin with a collateralized account — prepaid sums of money to the vendor that guarantee payments for future orders. Take whatever steps are necessary to build a vendor account, and pay it regularly so you’ll build business credit along with goodwill with the vendor.

Don’t forget that leases for office space, equipment and other assets may also help build your business credit. Ask lease holders to report your company’s payment history to credit reporting agencies if they don’t do so already.

-

Get supply trade references to Dun & Bradstreet:

Besides typical agencies, seek trade references that can be manually added to your credit file at Dun & Bradstreet. A "trade reference" is just what it sounds like: A business that will report on your business’ past transactions. Some trade reference firms automatically submit information, while in other cases, data must be sent manually. Be creative with who you ask — think about your attorney, your accountant or payroll service, your cleaning crew, a managed IT services company, uniform suppliers or your utility or gas company.

Bear in mind, however, that if you pay a trade reference late, that negative information also goes in your file.

-

Monitor business credit scores and ratings:

Periodically check your business credit scores and ratings with the various credit reporting agencies to ensure there are no mistakes or problems. Your company may also want to pay for regular monitoring through one of the credit reporting agencies that also tracks other agencies, such as Experian or Equifax.

-

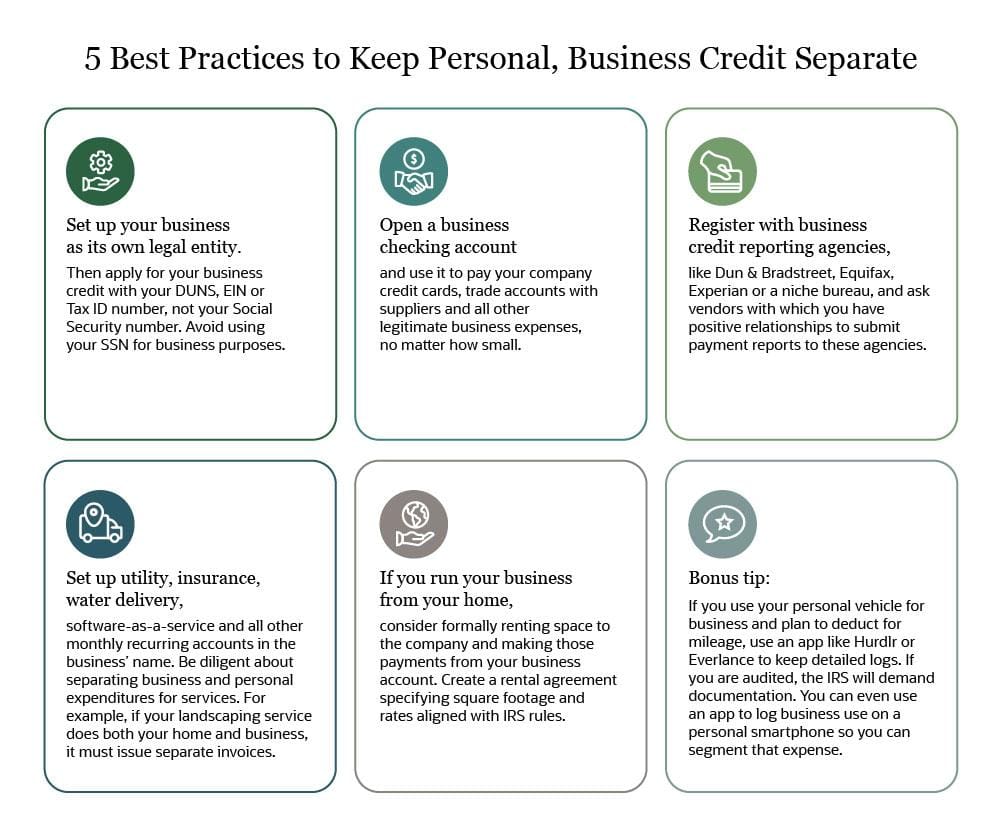

Keep business and personal finances separate:

Resist the urge to treat the business’ credit as though it were your own, even if you own the company. You can end up in a world of trouble with the IRS by mixing funds or using a company credit card for a personal expense, and few things will ding your credit like an IRS tax lien. If you happen to purchase something for the company with a personal account, be sure to reimburse yourself from the company account. It may feel pointless to move money around like that, but it is essential to keeping you and your company distinctly, legally and uniquely separate. Your accountant will thank you.

-

Borrow responsibly:

Some companies borrow money to establish credit, and that’s fine — as long as you can pay it back on time and the terms are favorable. However, you’ll incur less risk and improve your business credit scores if you borrow only what’s necessary. That way, you’ll have credit to leverage when you actually need it.

How Does Business Credit Work?

Business credit works much the same way as personal credit, but on a larger scale. Once credit is established, a business can typically borrow more money than a consumer (the owner) can. This secures access to funding for growth and to meet other needs.

Further, interest rates on business credit are generally more favorable than for consumers, and perks and rewards programs tend to be better suited for business use.

Once credit is obtained, it’s used by the business in much the same way as consumer credit. Expenses may be paid for with a business credit card or line of credit, and funds from loans can be spent immediately or held back to cover vendor invoices as they come in. It’s not a good practice to take out a loan to pay future invoices because that increases monthly costs through repayment and additional interest, defeating the purpose of the loan.

Importantly, also because banks wouldn't give a loan for this purpose — banks don't provide loans without some expectation of recouping the money. A new company would have to provide some form of collateral, such as a piece of equipment to be purchased with the loan, and future debt is not collateral.

Why Is Building Business Credit So Important?

Even with loans or lines of credit, many businesses still face challenges meeting operating expenses, servicing debt and purchasing needed supplies.

Even midmarket companies may not have enough cash on hand to cover every expense, meet every payroll date and purchase supplies. Most small-business owners rely heavily on credit to cover the periods between the outflow of cash for accounts payable and the inflow of cash from accounts receivable.

Financing

More than half of respondents in the Federal Reserve survey have used personal savings or funds from family and friends to finance their businesses within the last five years. In many cases, that’s because obtaining financing in the business’s name requires a business credit history and score.

Unfortunately, this means the debt is in the owner’s name, where it may negatively affect the owner’s personal credit score and income-to-debt ratio, which will hinder borrowing for personal or business needs. When small businesses establish their creditworthiness and secure financing early, that prevents a number of problems. If the firm has not established these, the financial institution will look to the owners’ personal credit history and credit score and issue the note accordingly.

Vendor and supplier relationships

Vendors prefer to work with businesses they know will pay in full and on time. Once credit is established with suppliers, orders are usually executed more quickly, which may boost your customer status and ensure you can get materials and goods in hand in a timely manner.

Protecting personal credit

We can’t stress enough the importance of establishing and maintaining good business credit unconnected to personal credit.

After initially establishing business credit, try to keep personal and business credit separate to increase access to financing for each entity — combine them, and the opposite may happen. And while business billing disputes and slow payments due to cash flow issues can reduce personal credit scores, even good business credit scores rarely have a beneficial impact on personal credit. So there’s no upside to combining finances.

If business accounts show on personal credit reports, the amount borrowed or charged can negatively impact your personal income-to-debt ratio, even when such accounts are paid on time. This could make it more difficult to secure personal financing, such as a mortgage or a car loan, and potentially prevent you from getting additional business funding, too. We’d call that a clear downside.

What Is in a Business Credit File?

Your business credit file is created by credit reporting agencies, such as Dun & Bradstreet and Equifax Small Business. A business credit file contains items similar to those in your personal credit file, namely an itemization of your company’s vital information and payment history. It may also include outstanding debts owed to vendors and lenders; when you opened business accounts; any publicly available records, including liens or bankruptcies; and additional data on your business, such as the number of co-owners and employees, annual sales and insights on your overall market or industry.

Because credit reporting agencies routinely and actively collect data on businesses from a variety of public and private sources, your business may already have a credit file — even if you’re unaware of its existence. If you find that a file does exist, order a business credit report so you can review it for inaccuracies. If no credit file on your business exists, start one.

Free Building Business Credit Checklist

Business credit is the cornerstone of your company’s financial health, so it’s worth devoting time and attention to building a great reputation. Properly segregating business and personal finances will also help you stay right with the IRS.

Your accountant can offer advice, but at minimum, check your score regularly. If you’re in credit-building mode, it may be worth investing in a monitoring service to deliver reports and alert you if your numbers slip.

Taking care of your business credit score will go far in helping you fund growth and get through cash flow problems.