In the first decade of this century, according to McKinsey & Company, publicly listed consumer packaged goods (CPG) companies enjoyed healthy annual revenue growth of 9%, on average—to the sheer delight of business owners and investors. At that point, CPG firms were on a roll, reliably producing stable, predictable returns while leaning on smooth-running supply chains to quickly and cost-effectively whisk a variety of consumer goods—from snack foods and pet supplies to cosmetics and household cleaners—to store shelves. Meanwhile, consistent consumer demand and strong brand loyalty kept sales figures steady and healthy.

However, storm clouds have since rolled in, dampening those easy-breezy days. In recent years, global CPG industry growth has dropped to almost zero, McKinsey reported in 2024, as companies have struggled with multiple issues, including rising costs due to inflationary pressures, increased competition for consumer attention, and ongoing supply chain disruptions. Still, the CPG industry can take steps to resuscitate growth. To appeal to financially stressed consumers who are fed up with spending more to purchase less, CPG companies must start by rethinking their selling strategies and exploring new ways to compete.

10 CPG Industry Challenges Happening Today

The difficulties CPG brands face today are daunting. Supply chain disruptions continue to plague operations, as logistics delays, raw materials shortages, and rising transportation costs make it harder to guarantee consistent product delivery. At the same time, inflation and increased labor expenses are squeezing profitability. Add to that the pressure of keeping up with changing consumer preferences, managing inventory levels to align with customer demand, and meeting evolving regulatory requirements. To be sure, CPG companies are faced with more than their fair share of hurdles. Here’s a look at 10 challenges facing the CPG industry today, along with tips for overcoming each obstacle.

-

Supply chain disruptions: A half-decade since the start of the COVID-19 pandemic, CPG companies are still wrestling with significant supply-related issues. A combination of factors, including national disasters, geopolitical conflicts, and port congestion, have created persistent logistics delays. In late 2024, for instance, the three-day US dockworker strike on the East and Gulf Coasts caused a major logistical bottleneck, with global container traffic coming to an abrupt halt—a feud that cost the US economy $540 million per day, according to The Conference Board.

Meanwhile, the CPG industry has seen a shortfall of several key materials, including cocoa, palm oil, coffee, sugar, eggs, and packaging materials (such as paper, plastic, and aluminum), primarily due to climate change impacts, geopolitical conflicts, and trade tensions. Shortages of those materials have led to production and fulfillment delays. Also, the cost of transporting goods has skyrocketed, partly due to rising fuel costs and a dearth of drivers, further straining the budgets of CPG companies. The US Bureau of Transportation Statistics reported in February 2025 that the annual change in the consumer price index, which helps measure inflation, rose 3.2% between January 2024 and January 2025 for all transportation goods and services. At the same time, President Trump’s proposed tariffs, targeting major trading partners such as China and Canada, have created uncertainty for global trade with the potential to cause additional supply chain volatility. Retaliatory measures from affected countries are exacerbating this instability.

To improve supply chain management, CPG companies can:

- Expand their supplier and transportation partners.

- Rely on a combination of rail, road, air, and sea services.

- Shift some of the production and sourcing of raw materials closer to the company’s base to reduce reliance on long-haul deliveries.

- Employ artificial intelligence and data analytics to optimize delivery routes, reduce unnecessary fuel consumption, and speed delivery times.

- Use real-time tracking systems to proactively manage supply chains, predict potential delays, and swiftly identify alternative suppliers and travel routes to keep products moving.

-

Rising costs: Between 2020 and 2024, the cost of delivering consumer packaged goods to consumers rose by about 25%, driven primarily by inflation-related increases in the costs of ingredients and packaging, according to PwC. Rising labor expenses have also contributed to the cost of producing and distributing products, with wages in the CPG industry increasing by about 30% since 2019, PwC says. As a result of these financial pressures, many CPG companies have felt the need to raise their prices to remain profitable. In fact, according to PwC, US shelf prices for consumer goods have surged about 30% since 2020. Yet, stagnant incomes are squeezing consumers’ wallets, making them increasingly price-sensitive, so many CPG leaders know they can’t continue to hike prices to remain competitive and sustain growth.

To manage rising costs while holding the line on price increases, CPG companies can:

- Conduct audits of their current operations to identify inefficiencies, reduce waste, and streamline production processes.

- Proactively negotiate better rates with suppliers.

- Explore the possibility of using less expensive ingredients.

- Switch to lighter and more cost-effective packaging alternatives to reduce material expenses.

- Use automation to help lower labor and production expenses and improve productivity.

- Deploy inventory management software to analyze supply data in real time, minimizing storage costs and avoiding the lost sales opportunities associated with stockouts.

-

Evolving consumer preferences: In recent years, customer preferences have shifted, particularly as consumers have increasingly sought healthier and more eco-friendly products. For instance, Trivium Packaging’s 2023 Buying Green report shows that 66% of the 9,000 consumers surveyed consider themselves environmentally aware, and 59% sought information about whether the packaging of the products they purchased was sustainable or recyclable. Also, consumers have become more aware of the health risks associated with sugar, artificial additives, and processed foods, nudging many to gravitate toward products that are organic, low in sugar, and free of harmful chemicals.

Plant-based food sales, meanwhile, reached $8.1 billion in 2023, a growth of 79% over the previous five years, according to the Plant Based Foods Association. In addition, the rise of digital-first shopping has reshaped the buying landscape, pressuring CPG companies to lower prices and offer perks, such as free shipping, as they compete for the attention of consumers who are carefully researching, comparing, and purchasing goods online.

To appeal to health- and environmentally conscious consumers, CPG brands can:

- Consider reformulating products to remove unhealthy ingredients in favor of more nutritious options.

- Be transparent about their ingredient sourcing and clearly communicate the nutritional benefits of products in their marketing campaigns.

- Ramp up digital marketing efforts by creating targeted ads to reach consumers as they research products online.

- Tap into influencer partnerships and content marketing efforts to build trust and awareness among consumers.

- Collect customer data to stay in tune with shifting consumer preferences.

- Invest in inventory management systems to help quickly meet the demands of online shoppers who expect fast, reliable deliveries.

-

Retail and ecommerce competition: CPG companies face a significant challenge in balancing direct-to-consumer (D2C) and traditional retail channels. In the past few years, the D2C business model—where companies design, manufacture, market, and sell their products directly to customers, rather than through intermediaries—has transformed the ecommerce industry. In the United States, established D2C brands generated about $135 billion in ecommerce sales in 2023, a figure that’s expected to reach $187 billion by 2025, according to Statista. However, traditional retail channels remain crucial for CPG brands, as brick-and-mortar stores still account for a significant portion of overall sales. Businesses often struggle with simultaneously navigating the complexities of digital and physical marketplaces, given their need to successfully manage logistics, marketing efforts, and customer expectations in both areas.

To succeed in this dual landscape, CPG businesses can:

- Leverage AI-driven inventory management tools to optimize stock levels across online and physical channels by analyzing real-time demand.

- Deploy order fulfillment software to manage inventory allocation and streamline deliveries.

- Implement omnichannel integration platforms to unify customer data, allowing businesses to send out personalized marketing messages.

- Take advantage of micro-fulfillment centers to improve delivery speeds.

- Consider partnering with third-party logistics providers to manage both bulk retail and ecommerce shipments under one consolidated network.

-

Trade spend and promotions management: Effectively managing trade spend and promotions remains a challenge for many brands. Historically, CPG companies have spent between 11% and 27% of their revenues on trade promotions, yet 61% of companies say they have trouble executing promotions as planned, according to a 2025 Promotion Optimization Institute report. Common problems include overspending on promotions that don’t generate incremental sales and failure to measure the outcomes of promotional activities. As a result of lax tracking, the return on investment (ROI) in trade and marketing campaigns is unclear, in many cases, which can erode profitability and prevent companies from steering their resources toward the promotions that bear the most marketing fruit.

To make sure every dollar spent on promotions drives measurable sales growth, CPG companies can:

- Conduct thorough post-promotion analyses by comparing actual results to forecasts, then reallocate resources to the most effective promotions.

- Take advantage of AI-driven data analysis tools to help optimize promotion strategies, predict consumer behavior, and improve targeting precision.

- Use advanced analytics to better assess the true ROI of trade spend, eliminate ineffective promotions, and focus on strategies that maximize profitability.

-

Inventory management complexity: Maintaining optimal stock levels has become increasingly complex, making inventory management more difficult for CPG businesses. With consumer preferences constantly shifting, brands may struggle to accurately forecast demand. Global political events, economic fluctuations, and new product innovations can also initiate sudden spikes or drops in consumer demand, catching CPG companies off guard. This unpredictability, combined with supply chain issues, can make it tough for brands to avoid stockouts, which lead to lost sales, frustrated customers, and potential damage to brand loyalty. At the same time, brands are also intent on avoiding overstocking, since holding excessive inventory ties up valuable capital, resulting in higher storage costs and the risk of unsold products becoming obsolete—especially in industries with short product life cycles or susceptible to quickly changing consumer tastes.

To address the challenges of managing complex inventory processes, CPG businesses can:

- Implement advanced demand forecasting techniques and real-time data analytics to more accurately predict consumer demand based on historical sales data, market trends, seasonal changes, external influences, and other factors.

- Employ inventory management software with real-time tracking, automated reorder alerts, and comprehensive analytics to help maintain the right levels of stock to meet demand.

- Adopt a just-in-time inventory approach to align orders from suppliers with production schedules, minimize holding costs and waste, and maintain flexibility to respond to sudden changes in demand.

-

Regulatory compliance: With the regulatory landscape constantly changing, it can be difficult for CPG businesses to keep up. Governments across the globe have been introducing stricter labeling, safety, and sustainability regulations, requiring CPG companies to invest substantial resources to remain compliant. For instance, in 2023, the US Food and Drug Administration implemented stricter guidelines for food labeling, requiring more transparent allergen information and clearer nutritional disclosures in an effort to improve consumer safety. And in early 2025, the FDA further proposed requiring front-of-package nutrition labels for most packaged foods in an effort to combat chronic diseases. Meanwhile, evolving regulations related to environmental safety are also pushing CPG brands to adapt quickly to different standards in different regions, particularly concerning packaging waste and carbon emissions. The costs of making changes to comply with new standards can be significant, requiring companies to redesign their packaging, update their labels, and even reformulate their products.

To navigate constantly evolving directives, CPG brands can:

- Establish a dedicated compliance team and partner with outside experts to anticipate and adapt to new standards quickly.

- Invest in scalable compliance systems to allow companies to simplify the process of implementing changes, such as updating product labels, redesigning packaging, or reformulating products.

- Leverage automation and compliance tracking technology to streamline operations and reduce the administrative burden associated with staying ahead of regulatory changes.

- Continually educate and train employees on updated regulations to reduce the frequency of errors and avoid fines and other penalties that can result from noncompliance.

-

Data fragmentation: CPG companies are grappling with the complexity of managing vast amounts of data related to their operations—information about everything from their point-of-sale systems and customer feedback channels to supply chain partnerships and manufacturing processes. This data is often fragmented, challenging companies to obtain a clear, cohesive picture of their overall business, including inventory levels, production schedules, consumer behavior, and market trends. Sales data may reside in legacy systems, for instance, while customer sentiment may be dispersed among various social media platforms, hindering the company’s ability to make informed decisions quickly. Plus, fragmented data can lead to costly mistakes. Without an integrated data strategy, for example, a brand might fail to accurately align its stock levels with customer demand.

To address data fragmentation, CPG firms can:

- Invest in advanced data integration platforms that consolidate data from multiple sources into a single, cloud-based system, eliminating the need to manually cross-check data.

- Use the resulting insights to accelerate product innovations, improve supply chain processes, and more effectively manage customer outreach.

- Develop data governance frameworks and conduct regular audits to ensure transparency and compliance with regulations that restrict the movement of data.

-

Customer retention and loyalty: Retaining customers has become a huge challenge for CPG companies. As the prices of food, beverages, and other consumer goods have climbed, shoppers have become increasingly cautious about their spending—tempting many to abandon companies they had remained loyal to for years and switch to less-expensive brands. In fact, a top-five reason adults in the United States, United Kingdom, and Australia try a new brand online is because it’s “cheaper than buying from other brands,” according to a Forrester Research survey. As price-conscious consumers continue to protect their wallets, brand loyalty is expected to drop a whopping 25% in 2025, Forrester predicts.

Customer retention should be top of mind for CPG brands. To help ensure success, companies can:

- Upgrade their traditional loyalty programs to meet changing consumer expectations, prioritizing personalization to strengthen connections with customers.

- Introduce loyalty features that move beyond points-based rewards to offer premium programs with exclusive discounts and other perks for members.

- Continually glean consumer insights through surveys and feedback loops, and use that information to refine strategies that build brand loyalty and retain customers over the long haul.

-

Technology adoption and integration: While businesses in most industries have been working diligently to reach digital maturity, CPG brands appear to be lagging behind other sectors, including healthcare, transportation, banking, and retail, according to a 2024 McKinsey report. CPG companies are among the poorest tech performers, largely because many wind up stuck in the pilot stage of technology adoption and don’t push for the broader, at-scale value that comes with integrating and relying on tools that streamline and automate operations. This challenge is further complicated by the rapid pace of technological advancements, particularly in the realm of AI. Brands that hesitate to harness AI will not only struggle to keep up with competitors, in terms of operational efficiency, but will have trouble meeting the average consumer’s expectations for seamless, tech-enabled experiences.

Investing in AI, automation, and analytics tools can enable CPG businesses to streamline operations, improve the accuracy of their targeting efforts, and deliver faster, more personalized responses to customer needs. The right technology can also improve the bottom line. In fact, a food and beverage company with $10 billion in revenue stands to gain between $810 million and $1.6 billion in top-line growth and productivity gains by implementing digital and AI successfully and comprehensively across its entire value chain, a 2024 McKinsey report shows.

The must-have advanced technologies CPGs should seek out include:

- AI-powered demand forecasting, which analyzes historical data, market trends, and other factors. This technology allows CPG brands to get a better handle on forecasting demand precisely, helping them predict customer needs and optimize inventory levels.

- Robotic process automation, which automates repetitive tasks, such as order processing, invoicing, and data entry, to accelerate back-end operations, minimize tedious manual work, and free employees to focus on more fruitful strategic tasks.

- Advanced analytics, which provides real-time insights into everything from sales and fulfillment data to production and logistics timelines. By integrating data across different functions, these tools produce critical information that allows companies to monitor key performance metrics, identify inefficiencies, and take quick, corrective actions that improve the business.

Overcome CPG Industry Challenges With NetSuite

Given the myriad challenges facing the CPG industry—from rising costs to lagging customer loyalty—today’s CPG brands need the right technology to help them quickly and cost-effectively get their products into the hands of buyers.

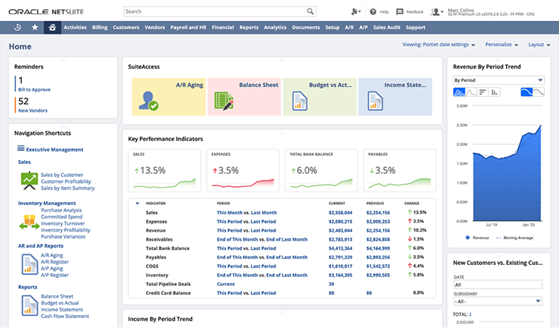

NetSuite Enterprise Resource Planning (ERP) allows businesses to do away with multiple, disparate applications and, instead, consolidate their data in a single, AI-powered, cloud-based solution. NetSuite ERP’s integrated suite of applications helps companies manage supply chain relationships, order processing, inventory monitoring, and production schedules, giving them greater visibility into their data and tighter control over their operations.

In addition, NetSuite ERP for the CPG industry is designed specifically for CPG companies, allowing businesses to quickly gain the insights they need from the data they gather in real time. In addition, the system enables CPG manufacturers and wholesale distributors to record all customer interactions automatically in a single, searchable system, providing a 360-degree view of their customers. That information is the key CPG companies need to unlock engaging customer experiences that build long-term brand loyalty.

CPG companies face numerous challenges that impact their ability to serve customers efficiently and maintain growth. Some of the most pressing issues include supply chain disruptions, rising costs, and shifting consumer preferences. To address these hurdles, CPG businesses should focus on strengthening their relationships with suppliers, conducting audits of their current operations to identify inefficiencies, and upgrading their loyalty programs to retain more customers. At the same time, companies must remain agile enough to adapt to emerging trends, such as an increased demand for sustainable products and the rise of digital-first shopping. Investing in cloud-based platforms, automation, and data analytics can help CPG firms simplify production processes, identify ways to reduce waste, and improve the customer experience—all of which are essential for driving business growth.

CPG Industry Challenge FAQs

What are the major trends happening in the CPG industry?

One major trend in the consumer packaged goods (CPG) industry is the shift toward improved health and wellness, with consumers increasingly choosing organic and plant-based products, as well as foods free of preservatives and other artificial ingredients. This has led to a sharp increase in demand for healthier snacks and beverages. In addition, CPG brands are responding to consumer demand for environmentally friendly products by providing clear information about their ingredients and moving to more eco-friendly packaging materials and recyclable options.

What is the biggest challenge in understanding consumer behavior?

The variability of individual preferences is perhaps the biggest challenge in understanding consumer behavior. After all, when making purchases, consumers are influenced by many factors, including their personal values, cultural backgrounds, and social circles, as well as external events, such as economic conditions and global crises. Without advanced technology, such as artificial intelligence and data analytics, it can be difficult for brands to analyze and predict what people want.