This article is part of a Grow Wire Guide on how to get VC funding. Download the full Guide as an e-book(opens in a new tab).

Getting an offer from the perfect VC partner must begin with research. You can only score meetings with VCs by first creating a targeted outreach list of firms that are aligned with your business.

The first phase of this process is understanding which VCs are a good fit for your company’s goals. The second phase is securing the meeting. This post will give you the tools to accomplish both tasks.

What Is Venture Capital?

Venture capital refers to a form of financing provided to early-stage, high-potential companies by investors known as venture capitalists. These investors typically inject capital into startups or small businesses in exchange for an equity stake, often taking on a higher level of risk in anticipation of significant returns if the company succeeds.

Unlike traditional bank loans or other forms of financing, venture capital is geared toward businesses with innovative ideas and substantial growth potential but that lack the necessary funds to scale rapidly. Venture capitalists not only provide financial support, but they also offer strategic guidance, industry expertise and valuable networks to help startups navigate challenges and accelerate their growth trajectory. This, in turn, fosters innovation, entrepreneurship and economic growth by fueling the development of groundbreaking technologies and disruptive business models.

Is Venture Capital Right for Your Business?

Determining whether venture capital is appropriate for a business depends on several factors, including the company’s growth stage, industry and objectives. Venture capital is best suited for high-growth startups with innovative products or services targeting large markets. For instance, if a business operates in a rapidly evolving industry with substantial growth potential and requires significant upfront capital to scale quickly, venture capital may be an attractive option. However, it’s essential to consider the trade-offs, as venture capital often entails relinquishing a portion of ownership and control to investors, along with high expectations for growth and returns. Venture capital isn’t suitable for all businesses, though, particularly those with slower growth trajectories or those in industries where profitability may take longer to achieve. By thoroughly evaluating growth prospects, funding needs and compatibility with venture capital investors’ expectations, businesses can determine whether pursuing venture capital is the right strategic choice.

How Does Venture Capital Work?

Venture capital operates through a structured process in which investors, known as venture capitalists, provide funding to early-stage or growth-stage companies in exchange for an ownership stake. The process typically begins with entrepreneurs pitching their business ideas to VCs, who evaluate the potential for high growth and significant returns. If interested, VCs then conduct due diligence to assess a business’s viability, market potential, team capabilities and scalability. Once both parties agree on terms, funding is provided to the business, often in multiple rounds as it progresses through different stages of growth.

Venture capitalists play an active role in supporting portfolio companies by providing strategic guidance, industry connections and mentorship. Ultimately, venture capital works by aligning the interests of investors with those of entrepreneurs to fuel innovation, drive growth and maximize returns on investment.

What Are the Benefits and Drawbacks of Using Venture Capital?

Venture capital offers several benefits to entrepreneurs. Chief among them are access to substantial funding, expertise, and networks that can accelerate growth and scale their business rapidly. VCs also often provide valuable mentorship and strategic guidance, which helps startups navigate challenges and capitalize on opportunities. Additionally, venture capital funding can enhance a company’s credibility and visibility, attracting additional investment and partnerships.

Still, venture capital isn’t without its drawbacks. Entrepreneurs typically relinquish a portion of ownership and control over their business to the VCs that invest in them. VCs also often have high expectations for growth and returns, which can create pressure to prioritize short-term objectives over long-term sustainability. Moreover, the process of securing venture capital can be highly competitive and time-consuming, requiring significant effort and resources. This focus on rapid growth and scalability may not align with the goals or values of all entrepreneurs or businesses.

Create a Target List of VCs and Determine if They’re a Good Fit

All venture capital firms have a specific focus regarding the kinds of companies they fund: They might invest mainly in software, consumer products, fintech, green technologies, AI(opens in a new tab) or any other number of categories. And each firm focuses on different stages of investment(opens in a new tab) (seed, early-stage, series A, series B and series C). Thus, the first step in reaching out to VCs is research. Here’s how to start.

Find venture capital firms that invest in companies like yours.

Create a roster of VCs that are likely to be interested in the kind of deal you’re offering, both in terms of industry and product. Look for firms that have a track record of investing in your industry and have funded companies similar to yours in terms of revenue growth and product focus.

You can start your search for specific firm names on CB Insights, a highly regarded resource that offers data on active VC firms and associated industries. Additionally, check out the CB Insights data-driven top 100 ranking to familiarize yourself with the heavy hitters of the VC world.

Ensure the firm invests in the stage of funding that you seek.

Which stage of financing are you in? Before adding a VC firm to your target list, be sure it’s actively pursuing deals in your stage.

Most venture capital firms share their investment ethos or criteria on their company website. For example, the investment criteria for Hummer Winblad Venture Partners (HWVP) identifies a focus on first institutional investments in “disruptive,” “emerging” software companies. If you have an early-stage company developing a software product, HWVP could be the right investment partner, and you should add it to your target list. If not, you should leave it off.

Check out the firm’s past deals.

Another way to determine if your company fits within a VC’s investment ethos is to review the firm’s recent deals, which you can usually find online. Even top-ranked venture capital firms like Accel Partners openly list their past deals. Reviewing them will help you determine if your company fits the firm’s prototype.

For example, Accel offers details on the type of businesses it seeks–and specific names of companies they’ve funded–in a blog post about their investment in fintech company Monzo:

“Over the years at Accel, we’ve backed many businesses reshaping large consumer categories with delightful user experiences,” the post reads. “Spotify with music, Etsy and Flipkart with commerce or Deliveroo with food are great examples.”

VC firms are transparent about the types of investments they make, so do your research upfront to find out if your company is a fit. You can also work backward: Locate a business similar to yours that has gotten funded and find out which firm invested.

Consider location.

Some firms only invest locally, while others are open to investing beyond their city and state. If you’re based in Denver and one of your target venture capital firms is based in San Francisco, be sure it makes out-of-state investments before sending an email.

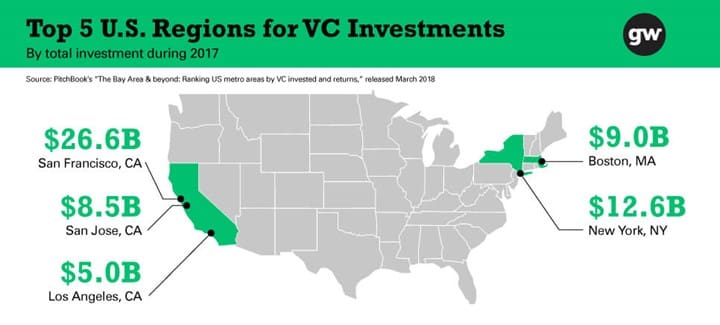

It’s worth noting that some regions receive more VC funding than others. Two-thirds of the country’s venture capital investment goes to just five metros–San Francisco, New York, Boston, San Jose and Los Angeles. However, VC firms are also willing to invest outside their regions.

Generally, it will be easiest to get attention from a local firm. However, if your business is truly attractive to VCs, location will not be a hindrance. Cleversafe(opens in a new tab) founder Chris Gladwin raised funds for his Chicago-based startup from a variety of VC partners outside his local market: NEA(opens in a new tab) in Menlo Park, In-Q-Tel(opens in a new tab) in Arlington, VA and San Francisco’s Alsop Louie Partners(opens in a new tab). The firms likely chose to invest because Gladwin was an experienced tech entrepreneur with three successful exits under his belt. Their out-of-market deals paid off big-time when IBM purchased Cleversafe for $1.3 billion.

Organize your list.

VC expert Joshua Henderson recommends including 20 to 30 investors and/or firms on your target list(opens in a new tab). You might consider tracking your communications in a spreadsheet like Corigin Ventures.

How to Reach Out to Your Target VCs

Once you’ve got a target list, it’s time to set up meetings. You have two opportunities to make connections: an intro from someone in your network or a cold email to a VC partner.

The “warm intro”

An introduction to a firm via a mutual connection from your business or personal network is called a warm intro(opens in a new tab). This is the best-case scenario, as VCs are more open to deals that come from a trusted source.

To find warm intros for your target list, ask yourself:

- Do you or your company’s team members have any direct contacts at VCs?

- Are there people in your extended network (i.e. parents, mentors, past employers, friends, professors) who have VC relationships?

- Does your company have board members(opens in a new tab) with VC connections?

- Can you utilize LinkedIn or business networking groups to connect with VCs in your area?

- Have you worked with a business incubator or angel investors that can help open up the next phase of introductions?

The “cold email”

You may not have mutual connections to some VCs on your target list. In that case, it’s time to start cold emailing your targets.

This is the more difficult way to get a meeting, but it’s not impossible. Allie Janoch, the CEO of environmental compliance company Mapistry, secured a $2.5 million seed round with a cold email. She outlines her best practices in a post on Medium(opens in a new tab).

Create a template.

A general template will be a helpful starting point for your cold email outreach. Put together the critical information about your business and current progress, and state why you’re contacting firms. This email has to grab a VC’s attention, so include any impressive revenue stats, major clients or other eye-catching facts.

Personalize emails to individual partners at each firm.

Broad information about your company can be pulled from the template, but the majority of each email must be personalized for a select partner at each firm. Partners within firms often have a sector focus. For example, a software VC firm like HWVP might have a partner who specifically funds and is considered the firm’s expert on deals with software companies like Gladwin’s Ocient(opens in a new tab), which deal with large-scale data storage.

Research the partner, and get a solid understanding of why they’re the person most likely to be interested in your project. In your email, mention the partner’s industry interests or other deals they’ve done that relate to your business.

Be direct and concise.

Get to the point quickly. Everything from your email subject line to the layout of the text should be clear, concisely explaining why your company is relevant to the particular VC.

After honing her cold email process, Janoch scored follow-up calls or meetings with a third of her targets, she wrote. The actual email she used to get a deal (with Jason Lemkin from SaaStr Fund(opens in a new tab)) is embedded in her post.

The Big Pitch

A meeting with a VC is your chance to pitch your big idea and ask for investment. The pitch will include information about your company and detail the product or service you’re developing. You’ll need to create a pitch deck for this. To learn more, read “The Perfect Pitch Deck and Presentation Style to Secure VC Funding(opens in a new tab).”

Enhance Business Viability for VC Funding with NetSuite ERP

Implementing an enterprise resource planning (ERP) system can significantly enhance a business’s operational efficiency, financial transparency and scalability, all critical factors in attracting VC funding. By centralizing and automating core business processes, such as accounting, inventory management and human resources, NetSuite ERP provides potential investors with real-time insights into a company’s performance and growth potential. This enhanced visibility into financial data, operational metrics and resource utilization not only instills confidence in investors, but it also demonstrates a business’s readiness for rapid expansion and efficient use of capital.

Getting connected to the right VCs to fund a business takes a thoughtful and targeted approach, one that requires careful research, strategic planning and effective communication. Whether securing warm introductions through existing networks or crafting compelling cold emails, entrepreneurs must tailor their outreach to resonate with potential investors. The process culminates in the pivotal pitch meeting, where entrepreneurs showcase their vision, business model and growth potential. While venture capital offers invaluable resources for scaling businesses, it also necessitates careful consideration of trade-offs, such as dilution of ownership and meeting high growth expectations. By leveraging the right insights and tools, businesses can navigate the complexities of venture capital and unlock opportunities for success.

#1 Cloud ERP

Software

How to Find Venture Capital FAQs

How do you find venture capital?

Venture capital can be found through targeted outreach to venture capital firms aligned with a business, leveraging introductions from mutual connections or through cold emailing targeted VC partners. Companies can increase the likelihood of securing funding by researching VC firms aligned with their industry, growth stage and funding needs to better inform outreach.

What are the main benefits of venture capital?

The benefits of venture capital include access to substantial funding, expertise and networks that can accelerate business growth and scale, along with valuable mentorship and strategic guidance provided by VCs that help businesses navigate challenges and capitalize on opportunities.

What are the five key elements of venture capital?

The five key elements of venture capital are equity financing for early-stage companies, investment by venture capitalists, high-risk investments with potential for significant returns, active involvement by investors in portfolio companies and funding provided in exchange for an ownership stake.