This article is part of a Grow Wire Guide on how to get VC funding. Download the full Guide as an e-book.

Rubber, meet road. You’ve built a business on a shoestring, borrowing from friends, family, savings, and your good name. The business is ripe for an infusion of capital, and you’ve been lucky enough to get some VCs to not only listen but also get interested. You’ve pitched and re-pitched, you’ve run and re-run the numbers, and now you can see a finish line in the form of a term sheet–that precursor to receiving an investment. Its purpose is to lay out the basic elements of a proposed deal.

Although it doesn’t guarantee investment, a term sheet is a very positive step in a company’s VC funding journey. Let’s take a closer look at the elements of a term sheet and how they might impact future business operations so that you can decide whether to accept an investment offer. We’ll also provide some practical advice, courtesy of a serial founder who has been through dozens of funding rounds.

What is a term sheet?

The dictionary defines a term sheet as “a non-binding listing of preliminary terms for venture capital financing.” CB Insights refers to it as “the first real piece of paper a founder sees from a VC when they decide that they’re interested in investing.”

A term sheet might also be called a “letter of intent,” “memorandum of understanding” or “agreement in principle.”

The term sheet is the first real step toward a successful financing transaction (aka “getting funded”), and it outlines the proposed investment at a high level. If the deal moves forward, lawyers will use the term sheet to draft transaction documents.

�� A note on lawyers

A lawyer is absolutely crucial in the term sheet process. Your company likely already has one if it’s mature enough to pursue VC funding, said Mark Mullen, co-founder of L.A.-based Bonfire Ventures.

“A good lawyer will help you set up the company properly so it’s prepared to take investment now and in the future,” Mullen said. “Then, you and the VC negotiate the deal [i.e. get a term sheet]. Then, the two lawyers–yours and the VC’s–put the paperwork together with feedback from you and the VC. A good lawyer should also be able to guide you through the documentation phase after a term sheet is signed.”

If you don’t have a lawyer, Mullen recommends finding one through your network or discussion boards on Y Combinator, a well-known source of startup advice. VC-heavy cities like San Francisco and L.A. have firms that specialize in early-stage company formation, he added. This type of legal counsel is relatively inexpensive compared to the payoff for your company.

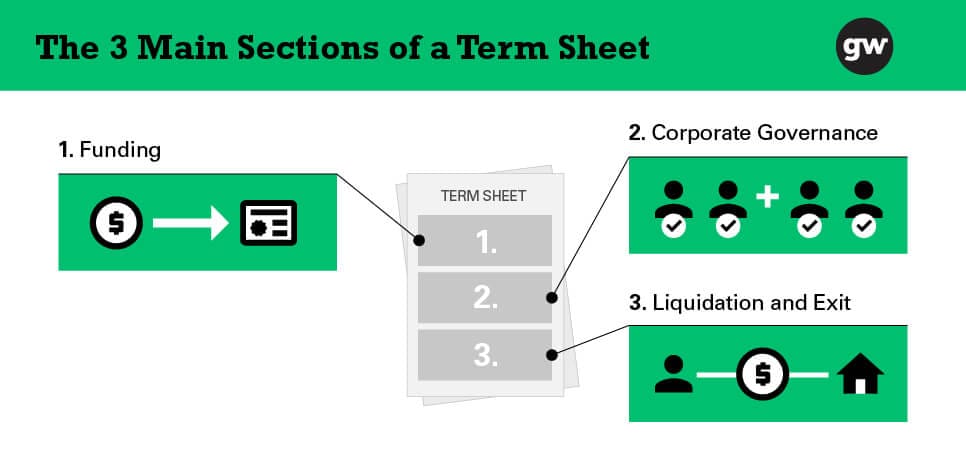

The 3 main sections of a term sheet

A term sheet has three main sections: funding, corporate governance, and liquidation and exit preferences.

1. Funding

The funding section lays out the financial guidelines of the proposed investment. It outlines how much money the VC firm is offering to invest and what it wants from your company in return, specifically some type of security and protection of that security.

A security can be “any proof of ownership or debt that has been assigned a value and may be sold,” according to the TheStreet.

In typical seed rounds, companies are often not yet “priced,” or given a valuation. Thus, in these deals, the security type is generally a convertible note or a safe (simple agreement for future equity, a term pegged by Y Combinator). Later down the line, in Series A deals, securities often take the form of equity, more specifically preferred stock.

Convertible notes were popular in VC circles for the past few years, Mullen said, but they’re falling out of favor. For seed rounds below $1.25 million, he recommends pursuing security in the form of a safe agreement.

A good lawyer will understand the market value of companies in your space, as well as conventional deal structures, according to Chris Gladwin, a five-time founder. Y Combinator’s “Guide to Seed Fundraising” is a good resource, as it further details options for the funding section.

�� A note on negotiations

You may be wondering what terms look like in a “typical” seed-round deal and how much room they leave for negotiation.

“While there are standard parts to a term sheet, there is no one answer as to the appropriate terms in regard to round size, ownership levels, preferences, or what type of security is right for a company at a given time in its in growth,” said Diane Fraiman, a software and digital media VC with Voyager Capital. She recommends relying on your company counsel–lawyers as well as other mentors–to determine the best terms for you.

Both Y Combinator and the National Venture Capital Association offer templates of what a “neutral” term sheet should look like, for reference.

Fraiman and Mullen agree that negotiation between founders and VCs is common in the term sheet process.

“Like any negotiation, it all depends on what type of leverage you have and what the situation is,” Mullen said. “… Naturally, a VC will offer X, and you naturally come back at Y. You might figure it out there, but it might take more discussion.”

2. Corporate governance

The corporate governance section of a term sheet outlines the governing structure for the organization. Its main purpose is to define the distribution of power between founders and investors as it relates to company decisions.

For early-stage companies, the corporate governance section outlines decision-making abilities, voting rights, and board composition, according to law firm Katten Muchin Rosenman. It also covers management and information rights and conditions that give investors access to the business premises, operations and financial data.

Corporate governance terms are important to investors, as they serve as protections around an investment. But they should also add value to founders by setting up a supportive relationship with VC partners. When you’re assessing corporate governance terms, ensure they both satisfy the security demands of investors and allow you to maintain some level of control over company operations. You should shoot for an equal number of “founder-friendly” and “VC-friendly” board members, according to Startups.co, an educational resource for founders.

Corporate governance is a balancing act. Like in any good partnership, the goal is to find a way to satisfy both parties and develop the best structure for future success. The “Anatomy of a Term Sheet” guide from Katten Muchin Rosenman will be helpful in navigating this part of the document.

3. Liquidation and exit

The liquidation and exit section of a term sheet describes what will happen to investors and shareholders if your company is liquidated, dissolved, or sold. It defines who gets paid first and highlights any particular preferences given to investors.

When your company is liquidated or sold, preferred shareholders will always be paid before common shareholders. (In Series A rounds, VCs usually angle to become those preferred shareholders.) Investors may also push for redemption rights, which require the company to buy back its stock at a specific time or when certain conditions are met. Redemption rights give investors an additional level of security by allowing them to potentially recoup their investment.

Founder desires vs. VC desires

A term sheet is like a tug-of-war between company founders and VC investors, in which founders are looking to “get the best deal” and maintain control of their company while VCs seek to “buy in at the best price” and set favorable investment terms for an exit. (This is when having a good relationship with your VC is handy.)

While the term sheet aims to lay out terms that benefit both parties, this can be a challenge when entrepreneurs and investors have different desires.

When negotiating a term sheet, you should consider the investor’s wants alongside your own, according to MaRS, a Toronto-based incubator. MaRS’ full list of motivations and recommendations is paraphrased below.

Common founder desires

- Finance the business toward growth and revenue goals while keeping a substantial portion of equity, which they’ll cash out in the event of an exit

- Structure financing so that investors are protected but long-term profit potential isn’t given away

- Develop investor relationships and get financing within a structure that lets the founder keep control of the business

Common investor desires

- Get the best return for their investment

- Protect their investment through liquidation preferences and special clauses that give them favorable options if the company doesn’t achieve the intended result (i.e. exit via sale)

- Maintain corporate governance protections, such as board seats and voting rights, to stay involved in major decisions

- Include clauses that keep founders and key members of the management team onboard for as long as they continue to add value to the organization

Investors can do their part to align the term sheet with entrepreneur desires in many ways, according to MaRS. They might include employee stock option plans (ESOPs) tied to critical milestones or vesting schedules that guarantee commitment. Veto rights against early sales can ensure the company isn’t sold before reaching its full value, and non-compete agreements and intellectual property rights can give investors additional layers of security.

Advice from a CEO who’s been through 40 rounds of funding

Chris Gladwin is an engineer, entrepreneur and CEO who has founded five technology companies. His last company, Cleversafe, was sold to IBM for more than $1.3 billion in 2015. Today, Gladwin is the CEO of Ocient, a company developing new ways to manage and analyze large datasets. Gladwin has negotiated more than 40 rounds of funding, making him uniquely suited to discuss term sheets from a founder’s perspective.

Gladwin identified three things a new founder should understand about the process.

1. A “hot” company will review multiple term sheets at once.

If your company appeals to one VC, it will appeal to many, Gladwin said. (This is especially true for technology growth companies, he added.)

As professional investors, VCs know which kinds of deals they’re looking for. They also know which kinds of deals don’t appeal to them.

“If you really have a great opportunity, most qualified investors will be interested,” said Gladwin. “Either no one wants to invest or everyone wants to invest.”

If your company is getting interest from one VC, Gladwin said chances are you’ll be reviewing multiple term sheets. Much like having two job offers at once, multiple term sheets give you leverage when negotiating with VCs for the terms you want. They also give insight into your company’s true value.

“Getting two independent term sheets at the same time is an excellent way of processing your value,” according to TechCrunch contributor Jonathan Friedman. “You can compare the two in isolation and get a more rounded view of how investors are appraising you.”

2. Choosing the right VC is as crucial as selecting the deal terms.

In addition to terms, Gladwin suggests founders carefully assess the VC deal from a partnership standpoint.

“Of course you should focus on the getting the best deal possible, but another important consideration, which is sometimes more important, is choosing the right partner,” he said.

The “right” investor is one who comes with benefits above and beyond the terms of the deal, Gladwin said. For example, an investor’s expertise and credibility might stand to benefit your business by helping with crucial decisions, offering access to a broader network, and opening up high-level sales and development opportunities.

“Who you have as an investor early on can really make a difference,” said Gladwin. “Just like hiring an employee, you want the best person.”

For more on this, see “How to Find the Right VC To Fund Your Business.”

3. Get advice from experienced professionals.

For new or less experienced entrepreneurs, access to solid mentors and advisors beyond your lawyer is critical during the term sheet review process.

Gladwin recommends building a network of mentors or former investors who are experienced in similar deal structures, so you can call on them for advice.

Then, get ready to sign.