Companies invest significant capital in fixed assets such as office equipment, heavy machinery, vehicles, and real estate. These assets play a critical role in how businesses generate revenue and meet the needs of customers. That’s why it’s so important to manage fixed assets carefully—they are essential for success. Here’s what you need to know about managing fixed assets to maximize efficiency, minimize the risk of accounting errors, and keep track of assets throughout their lifecycle.

What Is a Fixed Asset?

A fixed asset is an asset acquired by a company in order to generate revenue rather than to be sold. Fixed assets are tangible assets of significant value and are depreciated over a useful life of at least one year.

Fixed assets are classified as non-current assets because they are meant to be held for the long-term unlike cash and inventory, which are current assets expected to be converted into cash within one year. Examples of fixed assets include real estate, heavy machinery, computers, and vehicles. Fixed assets are usually listed as “Property, Plant and Equipment” (PPE) on a company’s balance sheet.

Capital assets is a broader classification that includes fixed assets and non-current intangible assets used to generate revenue, such as patents and licenses.

Fixed Assets vs. Current Assets

| Fixed Assets | Current Assets | |

|---|---|---|

| Examples | Vehicles Machinery Equipment Land |

Cash Accounts Receivable Inventory Prepaid Expenses |

| Easily and quickly converted to cash | No | Yes |

| Useful life | At least 12 months | Less than 12 months |

| Operating assets | Yes | Yes |

| Tangible | Yes | Sometimes |

| Depreciable | Generally, yes. Land is an exception. | Mostly no. Prepaid expenses are amortized. |

What Is Fixed Assets Management?

Fixed assets management is the process of recording and tracking long-term assets over their entire lifecycle, from acquisition to disposal. Companies must maintain accurate records to maintain compliance with accounting standards and reporting requirements. Examples include:

- Documenting the total acquisition cost of the asset, including shipping, installation and related fees, as well as its estimated useful life, maintenance requirements, and service history.

- Recording depreciation expense applying a consistent depreciation method and schedule. Tracking the status of fixed assets, such as transfers between facilities, divisions, or subsidiaries.

- Logging the financial impact of upgrades and other actions that increase an assets value.

- Recording asset impairments due to accidents, natural disasters, thefts, or other events that decrease value.

- Accounting for the sale or disposal of fixed assets, including any gains or losses incurred.

Key Takeaways

- Fixed asset management tracks and optimizes revenue-generating property, plant, and equipment throughout their lifecycles.

- Effective fixed asset management can lead to increased profitability, better customer satisfaction, improved compliance, and lower costs.

- Poor asset visibility, inaccurate record-keeping, complex depreciation methods, and complicated regulatory compliance can drain resources.

- Best practices for fixed asset management help safeguard investments while preventing operational disruptions.

- Technology supports fixed asset management by automating critical processes, providing comprehensive tracking, and generating real-time analytics.

Fixed Assets Management Explained

Fixed assets management involves both accounting and operational processes. Fixed-asset accounting records changes to status and book value of each fixed asset throughout its life cycle:

- Acquisition, including shipping, installation, and/or set up fees.

- Depreciation, an accounting method that spreads the acquisition cost of a fixed asset over multiple accounting periods. This smooths out the effect of a fixed asset purchase, avoiding a sudden increase in expenses that might skew financial results. It also better matches the expenses to the revenue they support. Depreciation reduces net income and tax liability.

- Non-routine maintenance that upgrades or extends the life of the asset.

- Impairment, damage, or obsolescence, if appropriate.

- Transfer and/or disposal, including any loss or gain on the sales of an asset.

Fixed asset management’s operational processes aim to optimize the use of fixed assets to maximize efficiency and income. This typically includes keeping a central register of all fixed assets, with the date they were put into service and estimated useful life. An asset record should also contain warranty information, maintenance manual and schedule, and service history, including upgrades and repairs. It may also involve keeping track of the location of fixed assets for proper oversight and to protect against theft.

Why Is Fixed Asset Management Important?

For many firms, fixed assets represent a considerable investment and generate much of a company’s revenue. Therefore, managing fixed assets to maximize the revenue they generate is key to business success. Managing fixed assets effectively can also reduce maintenance costs, help prevent unplanned downtime, equipment failure, or theft, and reduce the risk of accidents and legal claims. For large companies, avoiding these issues can protect revenue and save millions of dollars. Improving the efficiency and reliability of machinery, vehicles, and other equipment through effective fixed asset management can reap rewards in the form of:

-

Increased profitability.

Minimizing the ongoing cost and maximizing the income from fixed assets can contribute to higher operating margins, especially for a company with a large asset base.

-

Greater customer satisfaction and customer retention.

Fewer problems with equipment used for customer projects can contribute to greater customer satisfaction, which means they’re more likely to remain customers over the long term.

-

Less likelihood of compliance or safety problems.

Maintaining machinery correctly improves reliability and reduces the risk of noncompliance with safety or other regulations. Noncompliance can incur significant costs due to fines and lawsuits.

-

Lower maintenance and repair costs.

Tracking and following maintenance schedules can help companies avoid unplanned downtime, reduce expensive repairs, and extend the service life of equipment.

-

Employee engagement.

A reputation for operating efficient and reliable equipment can enhance a company’s overall image. In turn, this can make it easier to hire and retain high-quality employees.

-

Improved reputation with investors.

Because effective fixed asset management enhances profitability, it can potentially lead to lower costs related to obtaining capital earmarked for business growth.

Challenges of Fixed Asset Management

For the majority of companies, the primary concerns for fixed asset management relate to asset tracking, record-keeping, calculating deprecation, and compliance. Many organizations also find it difficult to maximize their investment in fixed assets over the various stages of ownership, especially given the rapid pace of technological change and increasing focus on environmental sustainability. For international businesses, the challenges take on global dimensions, involving currency fluctuations and even more diverse regulatory environments. Of course, each one of these challenges is multiplied as the number of fixed assets in a company grows, further complicating matters.

A closer look at the primary challenges follows:

-

Poor asset visibility:

This challenge refers to the difficulty in knowing the exact location, condition, and utilization of assets at any given time. It’s caused by a lack of proper tracking processes or systems. Poor asset visibility can lead to wasteful duplicate asset purchases, sloppy maintenance scheduling, and increased risk of theft or loss.

-

Incomplete or inaccurate records:

Records with unreliable or incomplete data can lead to inaccurate financial statements. This has a downstream impact on both taxable income and the entire audit process. Inaccurate records can also mislead the decision-making process, as well as create issues with insurance coverage and claims.

-

Tracking depreciation:

Accurately calculating and recording the depreciation of assets over time can be challenging due to complexity of depreciation methods. Calculation is further affected by real-world factors that change estimates for an asset’s useful life or salvage value, such as changes in market conditions or unexpected wear and tear. The diversity of a company’s fixed assets compounds this challenge by requiring different depreciation methods and having varying useful lives and salvage values. Properly tracking depreciation, as challenging as it may be, prevents misrepresented asset values and depreciation expenses on the financial statements and incorrect tax calculations. It also helps make budgets and forecasts more accurate.

-

Tax or regulatory non-compliance:

It can be difficult to keep track of the various tax laws and regulatory requirements related to fixed assets since they frequently change and can differ across jurisdictions. Non-compliance can result in penalties or fines from underpayment of taxes, missed fixed asset tax incentives that cause overpayment of taxes, increased likelihood of audits, and even reputational damage.

Key Features of Fixed Asset Management Software

Fixed asset management software helps companies track assets over their entire life cycle, from initial acquisition to sale or disposal. Ideally, the software should also automate financial processes such as depreciation, either by embedding these capabilities with the software or by integrating with a company’s accounting system. Here are some of the key features of fixed asset management software.

-

Logs all assets.

Fixed asset management software provides a complete and accurate log of all the company’s fixed assets in a central register, with asset IDs, barcodes and other tracking details.

-

Tracks key asset life cycle events and transactions:

Fixed asset management software tracks information for each asset over its service life, including acquisition date and original purchase price; installation and transportation costs; date of first use, estimated useful life; and expected and actual maintenance and repair costs.

-

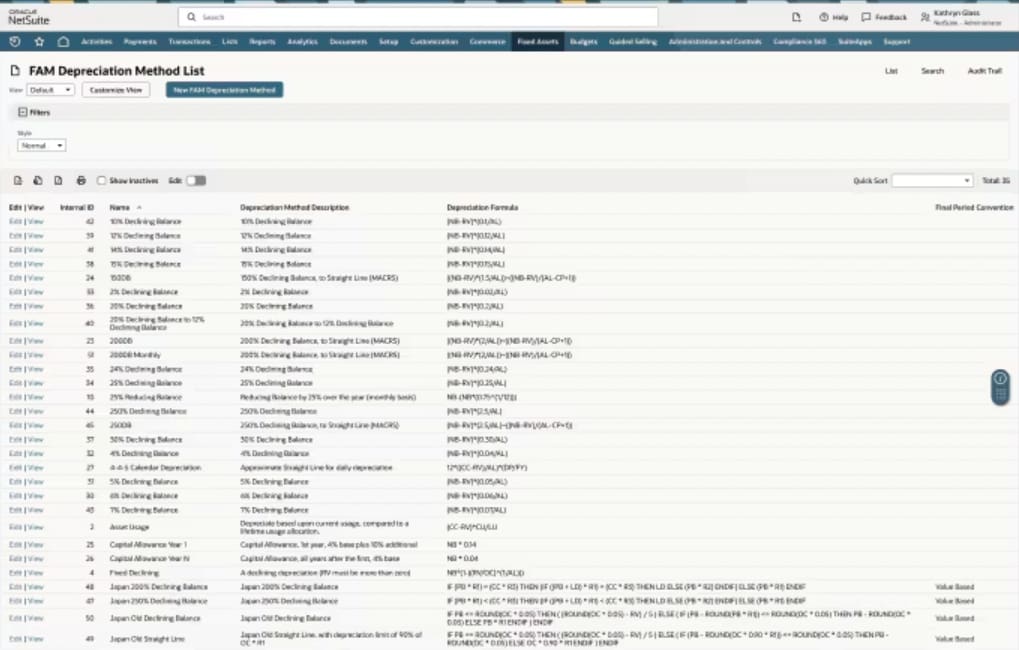

Automatically calculates depreciation:

Fixed asset management software should automatically calculate depreciation over the asset’s expected useful life. It should enable companies to choose the most suitable depreciation method and calculation schedule (monthly or annual).

-

Tracks asset disposal:

Fixed asset management software records the disposal of each asset, with dates. It maintains information such as whether the asset was sold, retired, or scrapped, together with any returns from the disposal.

-

Dashboards and reports:

Fixed asset management software provides dashboards for monitoring key metrics, as well as customizable management reporting.

Benefits of Fixed Asset Management Software

Fixed asset management software can help companies make the most of their assets, eliminate repetitive manual accounting, and avoid costly errors. Even small companies with fewer assets can realize considerable benefits by using fixed asset management software, rather than tracking fixed assets manually in spreadsheets. Key fixed asset management software benefits include:

-

Faster, more informed decisions:

Companies can make faster, better-informed decisions about fixed asset acquisition, deployment, and disposal because they can see at a glance the company’s full range of fixed assets, their cost base, where they are in their life cycle, and where they are deployed.

-

Automating manual processes:

Fixed asset management software saves time and increases accuracy by automating time-consuming and error-prone procedures such as depreciation calculations and lease accounting. Software also can reduce the potential for user error when recording asset redeployment and disposals.

-

Eliminating ghost assets:

Ghost assets are assets that the company no longer holds or that have become unusable—but still show up in company records. As a result, a company may be paying taxes or insurance for assets that it doesn’t have. Companies are particularly exposed to this risk if they rely on manually updated spreadsheets for asset tracking. Software that automatically records each step in an asset’s life cycle can greatly reduce the problem.

-

Improved compliance:

By keeping accurate records and ensuring timely maintenance, repair, and replacement of fixed assets, companies can improve compliance with accounting standards, health and safety regulations, and other legal and regulatory requirements.

-

Better business insights:

Leading solutions provide a wide range of reports that help companies quickly and easily identify trends and emerging problems.

Fixed Asset Management Best Practices

Fixed asset management becomes a strategic advantage when executed well. For starters, organizations should focus on regular training for all staff involved in asset management. This encourages better communication between departments and strengthens internal controls over the company’s valuable fixed assets.

Then, to further improve financial accuracy, reduce compliance risks, and support more informed asset decisions, consider the following best practices:

- Conduct routine physical audits: Verifying the existence, location, and condition of a fixed asset is an indispensable practice for maintaining accurate records, identifying discrepancies, and eliminating ghost assets. Physical audits are typically performed annually but may require a higher frequency for high-value or mobile assets.

- Stay on top of depreciation schedules: Choose the appropriate depreciation methods for different asset types. Document these accounting policies so they are applied consistently. Regularly review and update estimates that affect the depreciable base, including useful life and salvage values.

- Standardize asset disposal procedures: Establish clear criteria and approval processes for when assets should be disposed of. Make certain that disposal procedures include environmental and data security procedures, especially for computer equipment and other sensitive devices. Maintain easily accessible records with proper disposal documentation, including details of any proceeds from the sale.

- Make the most of your technology: Technology enhances every stage of fixed asset management by facilitating reliable, comprehensive tracking and automating consistent calculations for deprecation and gains or losses. Leverage data analytics for more informed decision-making, especially when it comes to forecasting and strategic planning. Other tips include using mobile tools for day-to-day asset tracking, such as GPS for vehicles and barcode scanners or RFID technology to streamline physical audits.

Choosing the Best Fixed Assets Management Software

The right fixed asset management software can reduce business costs and help businesses manage fixed assets more efficiently, leading to improved income generation, customer satisfaction, and business success. Here are some key steps toward choosing the best software for your business.

- Understand business needs: The first step when choosing fixed assets management software is to gain a good understanding of your business needs. Companies with complex manufacturing operations across multiple locations typically need software that enables them to quickly and easily report on the state of fixed assets in each location and across the business as a whole. Businesses that are gradually replacing aging machinery and other expensive assets may look for software that calculates depreciation and alerts them when it’s time to start the disposal process. Many companies need to record and track equipment leases. Businesses with a large number of fixed assets across multiple locations may want to consider a barcode-tagging system that can be used with mobile devices.

- Examine the automation potential: The next step is to think about the level of automation you need. For example, do you want your software to send emails to people who don’t return equipment? Do you want to schedule monthly or annual depreciation reports?

- Think about integration: For many companies, a further important step in the selection process is to examine the potential for integration with other business software. Leading solutions integrate with accounting software so that fixed asset acquisitions and disposals can be automatically included in financial reports without user intervention.

- Analyze budget considerations: Budget considerations are a key step in any selection process. One approach to setting a realistic budget is to estimate the cost reductions and profit gain you could reasonably expect from improving fixed asset management.

Manage Your Fixed Assets With NetSuite

NetSuite’s comprehensive Fixed Assets Management solution helps companies manage the entire asset life cycle from acquisition to disposal—without relying on spreadsheets and time-consuming manual accounting processes. NetSuite software enables businesses to maintain a detailed central register of all capital assets, both tangible and intangible, across multiple locations. You can automatically schedule monthly depreciation calculations, as well as amortization calculations for intangible assets, using standard templates or customized scenarios. Companies can also automate lease payments and maintain compliance with lease accounting standards. NetSuite helps companies identify ghost assets so they can stop paying to insure assets no longer in use. With comprehensive reporting capabilities, companies can quickly analyze costs, depreciation and amortization, lease expenses, and other data for any operational area.

NetSuite Fixed Asset Management Automates Depreciation

Effective management of fixed assets, such as machinery, vehicles, and facilities, can make a significant contribution to business success. Fixed asset management software can help companies get the most value from their fixed assets with minimal manual effort, resulting in increased income and greater customer satisfaction.

Fixed Asset Management FAQ

How do companies manage fixed assets?

Typically, fixed assets are tagged with a number or barcode that links to an entry in the company’s fixed asset register. Transactions and activities related to each asset—acquisitions, disposals, upgrades/repairs, thefts, accidents, and depreciation/amortization—are all recorded on the fixed asset register. Companies increasingly use fixed asset management software to manage their asset register, largely because it provides a more automated and less error-prone method than manually tracking assets in spreadsheets.

What is the role of a fixed asset manager?

The role of a fixed asset manager includes maintaining the fixed asset register, recording all changes to and movements of fixed assets, calculating depreciation and lease payments, accounting for asset disposals, and analyzing and reporting on the costs and income related to fixed assets.

What is a fixed asset process?

The fixed asset process encompasses all the steps involved in acquiring, deploying, and disposing of assets. The process typically involves six steps or facets:

- Decide to acquire the asset.

- Acquire the asset.

- Maintain the asset.

- Depreciate the asset.

- Retire or dispose of the asset.

- Report on the asset.

What is asset management?

Asset management is a broad term that can refer to managing various types of assets. The goal of asset management is to increase the capital or income of an enterprise. This can involve trading financial assets, such as stocks and bonds, or managing tangible assets, such as real estate.