Speedily-growing tech startups often get a hand from VC funding (opens in new tab). But even with money in the bank, acquiring credit from traditional lenders is difficult, especially for very young companies.

To solve this problem, Brazilian-born entrepreneurs Henrique Dubugras and Pedro Franceschi developed Brex, a fintech company offering corporate credit cards for startups with 10-20 times higher limits than traditional cards and no personal guarantee required.

Brex products saw quick adoption. The company hit $10 million in annual recurring revenue (ARR) in approximately 18 months after its 2018 launch. This past May, Brex acquired three companies and closed yet another round (opens in new tab) of its own VC funding, for a total of $465 million raised thus far. With over 400 employees, multiple subsidiaries and offices in the U.S. and Canada, Brex continues to support startups looking to scale faster by, well, scaling faster.

To remain sustainable, the company had to manage its growth. Brex made the switch from QuickBooks to NetSuite ERP in preparation for a big future, including the possibility of an eventual IPO.

"We decided to switch to NetSuite because we wanted a system to support where the business was going,” said Kevin Moore, controller.

Brex prepares to enter new verticals with a new system

Before publicly launching, Brex realized it needed a more comprehensive ERP system to handle its accounting than QuickBooks provided. The ability to support multi-entity accounting within the context of a growing team was a priority for leadership. The system would also support Brex’s branching into new markets.

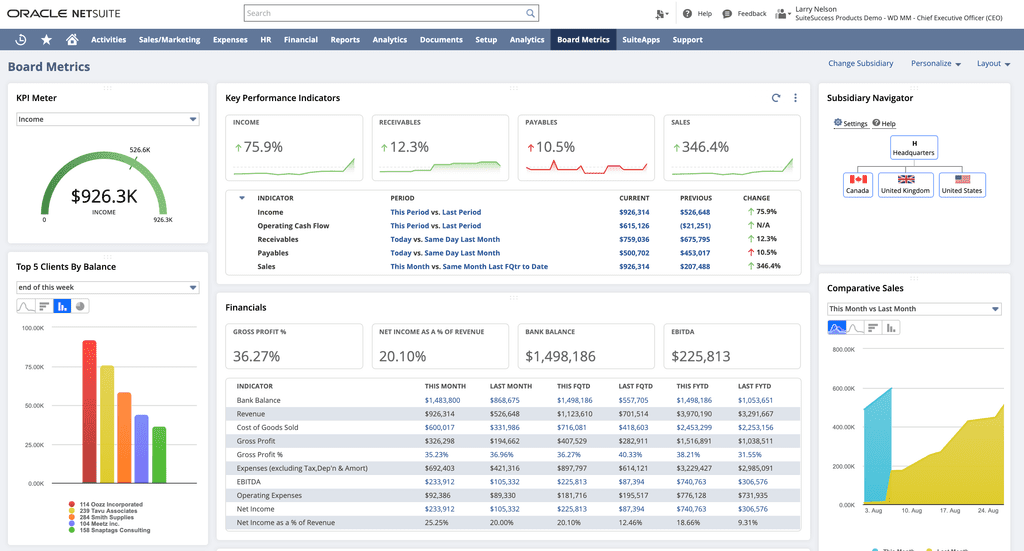

“As we expanded to additional verticals like ecommerce, life sciences and offer different products, we wanted to be able to see every box clearly and analyze how we’re doing from a business perspective,” said Chief Accounting Officer Erik Zhou.

“As we expanded to additional verticals … we wanted to be able to see every box clearly and analyze how we’re doing from a business perspective.”

- Erik Zhou, chief accounting officer

Doing more, faster with NetSuite

Moore and Zhou cited a few elements of NetSuite as especially helpful to Brex:

- Multi-entity accounting

Brex has opened multiple subsidiaries, including one in Canada, which requires an ERP solution with multi-entity accounting. NetSuite OneWorld allows Brex to pull data from multiple business units, develop consistent processes and meet global accounting and compliance standards.

It also “allows us to allocate costs such as rent based on headcount across offices,” Moore said. “This type of inter-company and multi-entity accounting is just something that QuickBooks doesn’t allow.”

- Out-of-the-box functionality

NetSuite’s integration capabilities allow Brex to connect it with other software providers, bringing major components of Brex’s tech stack together in a single system. Additional customization options solve company-specific challenges, such as processing electronic payments with bank partners and creating integrations with Brex's own technology systems.

“The integration capability of NetSuite with other platforms has been beneficial," Zhou said. "Because of NetSuite, we haven't had to add additional headcount to manage AP and the procurement process.”

According to Moore, fast-growing companies need financial systems with built-in checks and balances. These control functions help ensure that the data provided to leadership is reliable, so that they make better business decisions. They’re also essential during audits.

“You need solid checks and balances to have your books aligned for an audit by a big four firm," Zhou said.

To that end, Brex uses NetSuite OneWorld to keep a steady audit trail, access audit-relevant logs and workflows, and drill down into the details of transactions where needed.

- Integration with other software tools

NetSuite's standard accounting functionality and advanced features such as automated depreciation and amortization, cash management and tax compliance help Brex support a complicated business.

Before NetSuite, company leaders had to pull monthly depreciation and amortization reports from Excel spreadsheets. Now, “it’s just a one-button push for the month-end process," Moore said.

"Because of NetSuite, we haven't had to add additional headcount to manage AP and the procurement process.”

-Erik Zhou, chief accounting officer

Brex’s future plans

In the future, Brex plans to expand its financial services and software offerings, and increase its reach to more industries. NetSuite ERP is the platform supporting the next stage of the company’s evolution.

"We can build NetSuite out to support the needs we have going forward," Zhou said.